India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

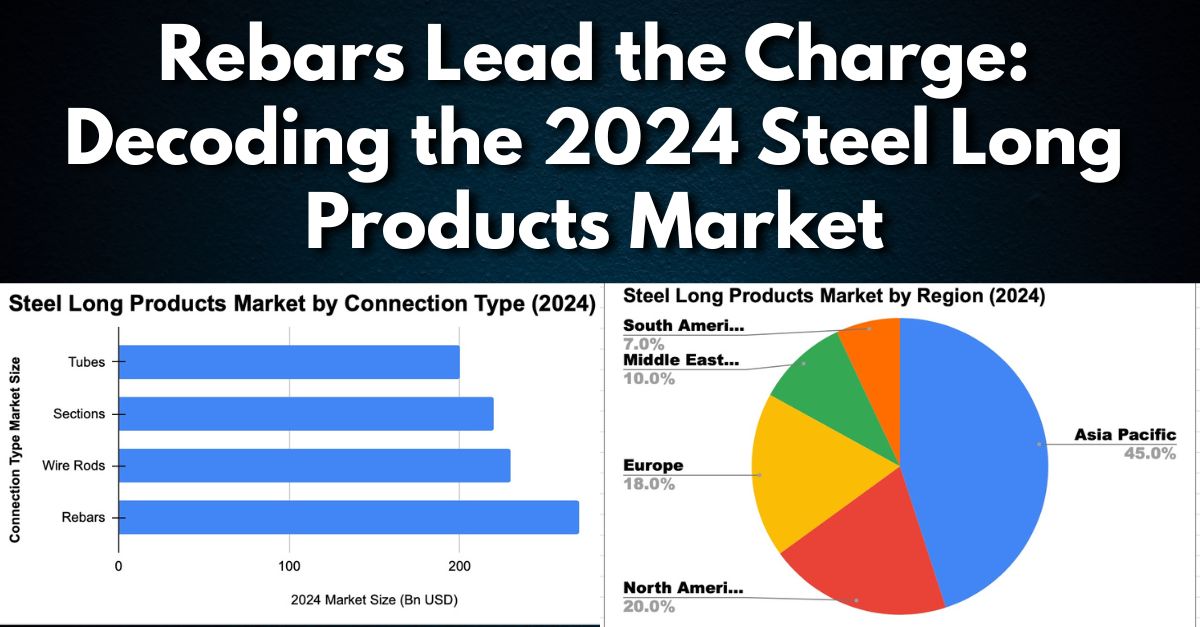

The global steel long products market continues to be the backbone of industrial progress, with 2024 shaping up as a pivotal year. Data shows that Rebars, Wire Rods, Sections, and Tubes dominate the market — not just in volume, but in how they reflect the industrial and infrastructural priorities of emerging and mature economies alike.

Connection Type 2024 Market Size (Bn USD)

Rebars 270

Wire Rods 230

Sections 220

Tubes 200

🏗️ Rebars: The Pulse of Infrastructure

Rebars account for 30% of total steel long product demand, a staggering figure that speaks volumes. With mega projects like high-speed rail networks, smart cities, and highway corridors expanding in India, Southeast Asia, and the Middle East, rebars are riding the wave of reinforced concrete innovation.

💡 Did you know? The Indian government’s PM Gati Shakti infrastructure program is expected to increase domestic rebar demand by over 12% in FY 2025 alone.

🔩 Wire Rods & Sections: Feeding Industry's Core

Wire rods, used in everything from fasteners to mesh reinforcements, are key to not just construction but also manufacturing and automotive growth. Their near-parity with rebars signals strong multi-sectoral demand.

Sections (like I-beams and channels) are favored in steel-intensive infrastructure like warehouses, industrial sheds, and bridges — especially in African and South American economies pushing for industrial upliftment.

🛢️ Tubes: Silent Yet Strategic

Though fourth in the table, tubes are stealth drivers of transformation in oil & gas pipelines, HVAC systems, and scaffolding. With global energy transitions underway, expect this segment to see sustained growth in both volume and tech upgrades (like corrosion-resistant coatings and flexible alloys).

🔍 SB Strategic Insight

The segmentation speaks to a broader market behavior — where urbanization, industrial capex, and energy shifts are directing steel consumption patterns.

“Smart manufacturers are no longer chasing volume alone. They're pivoting towards product-line precision — ramping up rebar production for Tier 2 city construction, or customizing tube production for LNG pipeline projects.”

— SteelBazaar Insights

🔮 What Should Steel Stakeholders Do Next?

✅ Mill owners should align capacity with high-growth segments like rebars and wire rods.

✅ Distributors must stock strategically based on regional project pipelines.

✅ Investors & policymakers need to view product-wise growth as a signal for where steel capex will flow.

📌 Final Thought

Steel long products are not just materials — they are economic indicators, policy levers, and innovation canvases. 2024's figures reaffirm one truth: wherever growth is rising, steel is the foundation — and long products are the skeleton.

Also Read : Global vs Indian Steel Demand – A Diverging Path in 2025 China’s Steel Production Cools in March: Hebei Leads, Shanxi Records Surprise Surge