India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

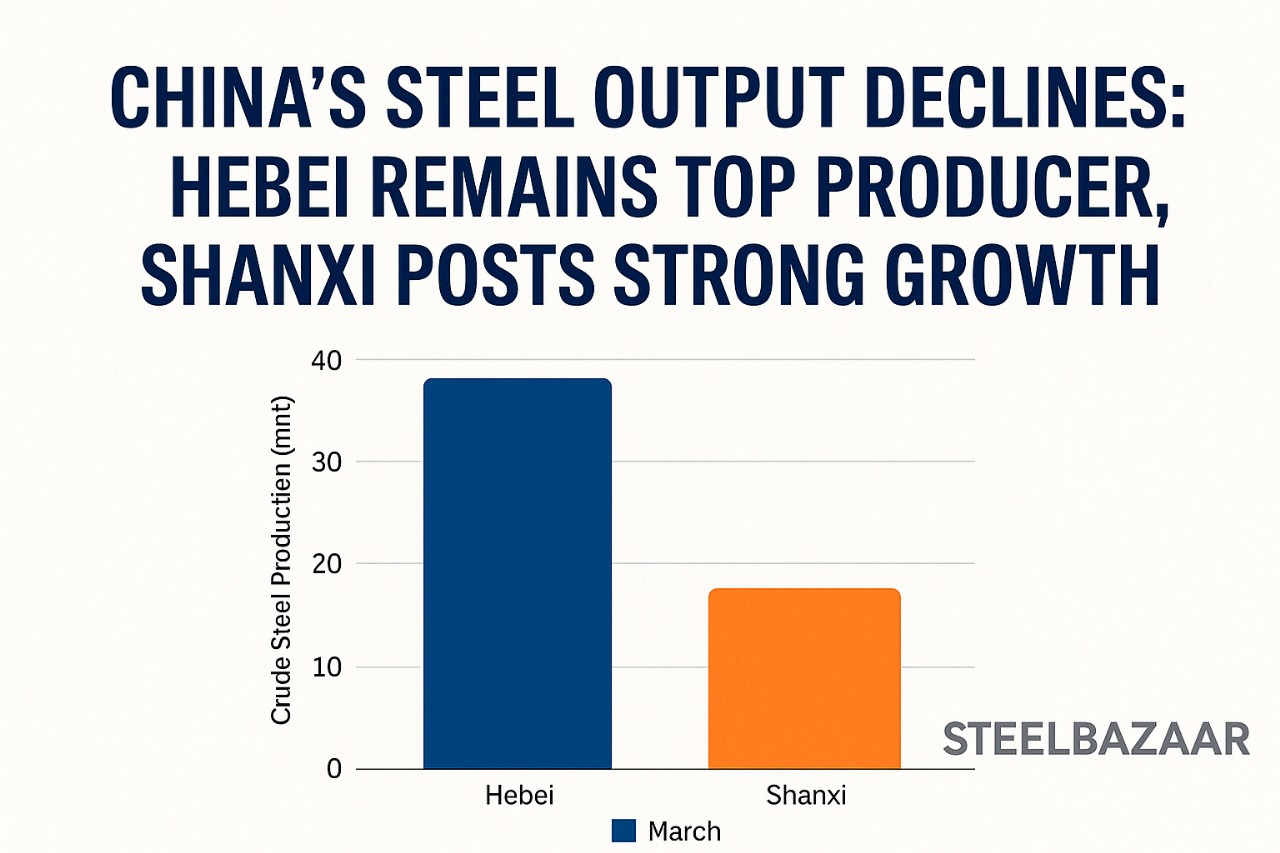

China’s latest provincial data for March 2025 reveals a mixed performance in crude steel production. While heavyweights like Hebei, Jiangsu, and Shandong continue to dominate in volume, most provinces reported a year-on-year dip, signaling strategic slowdowns or controlled capacity utilization.

📌 Total production in Hebei stood at 35 million tonnes, down 3% YoY — a reflection of curbed output amid tightening environmental norms and tepid demand.

📊 Key Provincial Performance (YoY Change)

Hebei: 35 mnt (🔻 -3%)

Jiangsu: 20 mnt (🔻 -3%)

Shandong: 12 mnt (🔻 -1%)

Liaoning: 11 mnt (🔻 -2%)

Shanxi: 10 mnt (🔺 +8%)

🟢 Shanxi emerges as the standout, with 8% growth YoY, likely driven by robust demand from construction and favorable operating margins from integrated players.

🔍 Market Interpretation: Structural Adjustments in Play

Industry insiders suggest that the decline in key provinces is part of a planned output moderation, aligning with:

National decarbonization targets

Softened infrastructure demand post-Lunar New Year

Lower profitability on export orders

Meanwhile, Shanxi's upward move could reflect strategic stockpiling or rising billet requirements in regional markets.

📌 SteelBazaar View

With most provinces charting negative or flat growth, China's steel production landscape appears to be rebalancing. The rise in Shanxi offers a counterweight, but the broader trend hints at:

📉 Continued output discipline

📦 Tight domestic supply

💸 Potential upward pressure on regional prices

Market watchers should closely track April output numbers and upcoming government cues, especially regarding infrastructure stimulus or export push.

Also Read : South India’s Steel Sector: Rising Output, Shrinking Inputs Steel Market Price Trends: Analysts Predict Recovery in HRC & Rebar Prices