India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

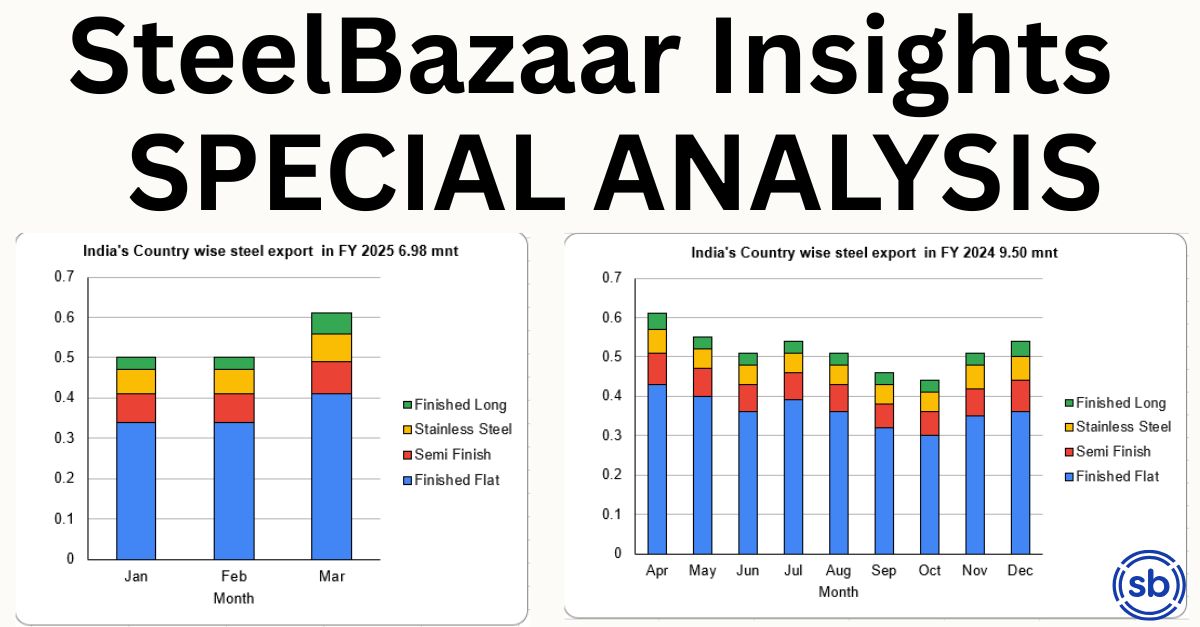

Provisional monthly data from FY’25 (April to March) paints a detailed picture of India’s steel export performance across both product categories and top destination countries. Despite a challenging macro environment, India managed steady outflows across major categories.

🔩 Commodity-wise Trends (Apr–Mar FY'25)

Commodity Range (mnt) Peak Month Lowest Month

Finished Flat 0.34–0.43 Apr (0.43) Jan–Feb (0.34)

Semi-Finished 0.07–0.08 Apr (0.08) Feb (0.07)

Stainless Steel 0.05–0.07 Mar (0.07) May–Oct (0.05)

Finished Long 0.03–0.05 Mar (0.05) Jul–Feb (0.03)

➡️ Observation: Finished Flat consistently dominated export volumes, while Stainless and Semi products maintained stability. A slight pickup in March hints at possible revival heading into FY’26.

🌍 Top Export Destinations – Country-Wise Flows

Country Monthly Average (mnt) Peak Month

European Union 0.26 (Apr) → 0.27 (Mar) Mar (0.27)

Nepal Steady at 0.06–0.08 Mar (0.07)

UAE Hovered around 0.05–0.06 Jan–Mar

United States 0.02–0.04 range Mar (0.04)

Saudi Arabia Consistent at 0.02 Mar (0.03)

Others 0.16–0.23 Mar (0.23)

➡️ Observation: EU remains India's largest steel buyer, while UAE and Nepal show resilience. Volumes rose slightly in Q4, despite global pricing and trade challenges.

🔍 SB View: What This Means for FY’26

📉 India saw a sluggish H2 FY’25, but signs of rebound emerged in Feb–Mar across both commodity and destination metrics.

📦 Exporters are encouraged to focus on:

High-volume flat products

Long-term buyers like EU & Nepal

🔁 Recovery is expected if Chinese exports slow further and duties in Vietnam and EU ease.

✅ SteelBazaar Recommendation

Use Live RFQs to tap buyers in EU & MENA markets.

Optimize grade-wise exports with custom finish & sizes using SteelBazaar’s product mapping.

Track export trends monthly via SteelBazaar dashboards to stay ahead of demand shifts.

Also Read : The Impact of Chinese Steel Exports on Indian Companies SteelBazaar Insight – March 2025 Market Analysis