India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

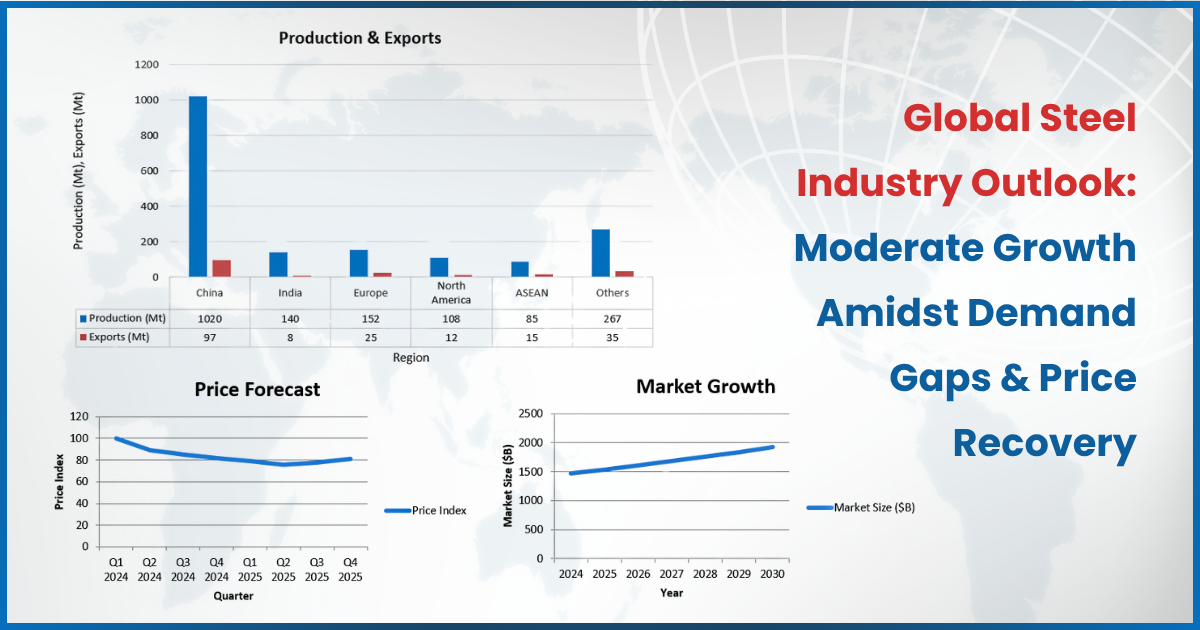

The global steel industry continues its upward trajectory into 2025, with the market poised to reach $1,537 billion, growing at a CAGR of 4.6% through 2030. Yet, behind this growth lies a concerning supply-demand mismatch and regional performance asymmetry—especially between Asia and Europe.

While China remains the production giant with over 1,020 million tonnes, it faces falling demand (▼1.5%) and increasing export dependency. In contrast, India and ASEAN show stronger domestic momentum, recording demand growth of 3.2% and 4.5% respectively.

Global steel prices, as per the Steel Price Index, have dropped from 100 in Q1 2024 to 76 in Q2 2025, reflecting subdued demand and oversupply. Encouragingly, analysts expect a trend reversal in Q3 2025, with prices inching up toward 81 by year-end.

With global steel capacity at 2,450 Mt versus expected demand of only 1,772 Mt, the industry faces an excess capacity of 678 Mt—a structural imbalance threatening profitability and efficiency.

Steel consumption is primarily fueled by construction (35%) and infrastructure (18%), together accounting for over half the market. Fast-growing areas include consumer goods (5.7% growth) and automotive, although the latter remains subdued at 2.8%.

ASEAN and India show the strongest growth in steel demand.

China leads in production but faces internal slowdown, prompting heavier exports.

Steel prices may have bottomed out, offering procurement windows.

Excess capacity remains a systemic risk, especially in regions like Europe.

Construction & infrastructure continue to dominate demand, shaping policy focus.

Capacity additions must align with regional demand forecasts to avoid price crashes.

Buyers should plan procurement cycles to leverage Q3–Q4 recovery windows.

Countries like India must manage infrastructure growth with raw material access.

Export-heavy nations may face anti-dumping actions and trade restrictions.

SteelBazaar provides:

✅ City-wise marketplace data across primary and secondary steel

✅ Smart quoting tools with price trend integration

✅ Real-time capacity vs demand alerts by segment and location

✅ 25,000+ active SKUs with mill, trader, and OEM listings

Also Read : India's mega investment summit: A gateway to global partnerships and economic growth SB Special | Structural Steel: Building the Backbone of Global Growth