India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

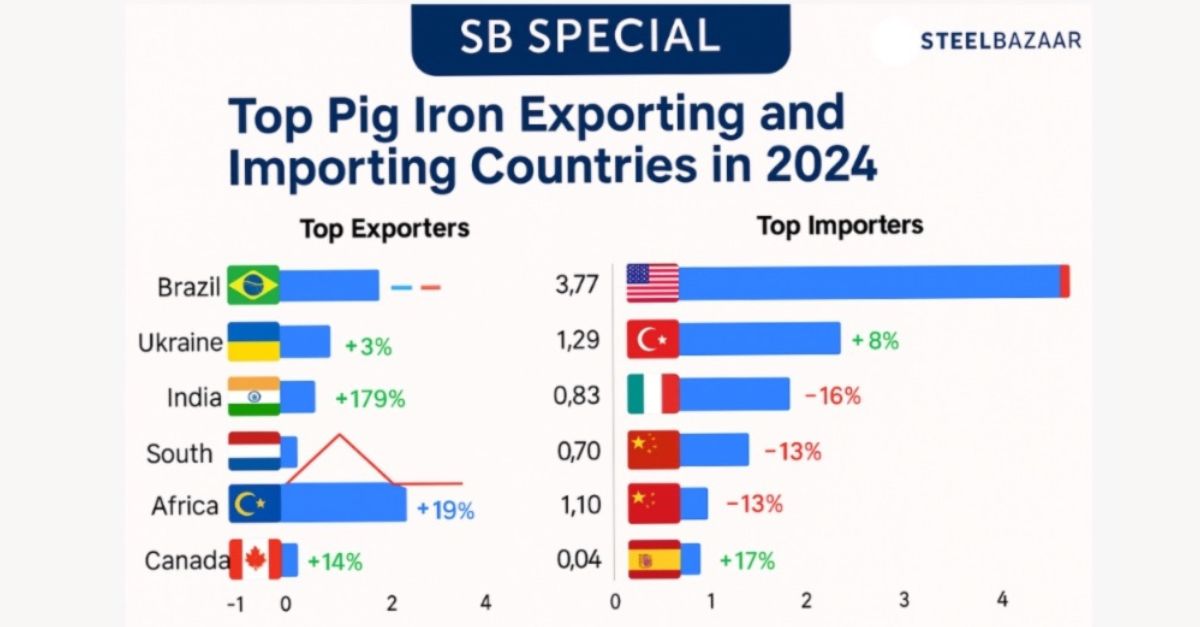

India has marked a remarkable entry into the top league of pig iron exporters, showcasing a 179% year-on-year growth in exports—the highest among global peers in 2024. While Brazil remains the leading exporter by volume, India's meteoric rise underscores a strategic shift in its global trade footprint.

🔼 Top Exporters of Pig Iron (2024)

Country Quantity (mnt) YoY Change

🇧🇷 Brazil 3.77 ▼ 2%

🇺🇦 Ukraine 1.29 ▲ 3%

🇮🇳 India 0.83 ▲ 179%

🇿🇦 South Africa 0.70 ▲ 6%

🇨🇦 Canada 0.10 ▲ 14%

🇰🇷 South Korea 0.04 ▼ 60%

India’s growth is attributed to:

Strategic exports to Southeast Asia, the Middle East, and the US

Strong pricing advantage amid global scrap shortages

Rising global tariffs on finished steel creating new feedstock demand

🔽 Top Importers of Pig Iron (2024)

Country Quantity (mnt) YoY Change

🇺🇸 United States 4.70 ▲ 8%

🇹🇷 Turkey 1.47 ▲ 6%

🇮🇹 Italy 1.34 ▼ 16%

🇨🇳 China 0.34 ▼ 13%

🇪🇸 Spain 0.27 ▲ 17%

The US continues to dominate pig iron imports, driven by:

The 25% import tariff on steel driving demand for feedstock alternatives

A sharp rise in US-origin scrap prices

Growing dependency on Indian pig iron amid reduced supplies from Brazil

📉 SB Takeaway

“India’s 179% export growth is not just a number—it's a statement. The country is swiftly positioning itself as a reliable global feedstock hub. With strategic pricing, capacity enhancement, and diplomatic agility, Indian exporters are rewriting the global pig iron narrative.”

Also Read : Navigating the Steel Market: Prices Recover, But Capacity Pressures Loom SteelBazaar Monthly Recap – March 2025 Edition