India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

March 2025 brought significant developments in the steel market, shaping domestic and global trade dynamics. India’s proposed 12% safeguard duty on steel imports aims to protect local manufacturers, while exports saw an 8.6% dip due to reduced global demand. Despite this, domestic steel prices, including TMT, HR, and CR coils, remained stable. The push for green steel is gaining momentum, with global partnerships influencing India’s decarbonization efforts. Meanwhile, steel demand projections have been revised upward to 9% for FY25, driven by infrastructure and housing growth. SteelBazaar insights provide a data-driven outlook on price trends, global trade shifts, and strategic recommendations for industry stakeholders.

🔍 Tracking Trends | 📊 Prices | 🧠 Insights | 🏛️ Policy | 🌍 Trade

📌 Top 5 Steel Market Highlights – March 2025

🇮🇳 India Proposes 12% Safeguard Duty on Steel Imports

➤ Aim: Protect domestic manufacturers from rising imports

➤ Impact: Boost in steel stock prices (Tata Steel +3.7%, JSW +3.2%)

➤ Analysts expect temporary price stability in domestic markets

📉 Steel Exports Dip by 8.6% in February (Reported in March)

➤ Engineering exports fell due to reduced shipments of iron & steel

➤ Major global buyers pulled back amid oversupply fears

📈 Domestic TMT, HR, and CR Prices Hold Steady

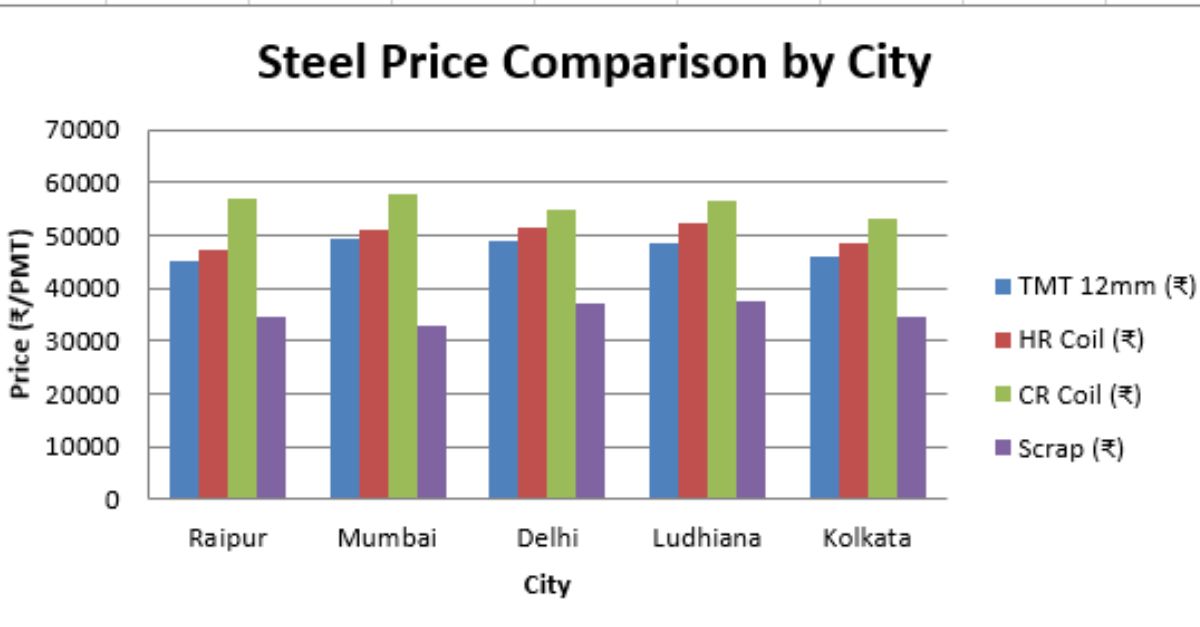

➤ TMT 12mm: ₹45,000–₹50,200 across major cities

➤ CR Coil: ₹53,000–₹58,000

➤ Scrap: ₹30,200–₹37,700

➤ Ingot & Billet: ₹38,100–₹44,500

🌱 Green Steel Gathers Momentum

➤ Global partnerships (e.g., China’s HBIS & Vale) move toward decarbonization

➤ Indian firms expected to follow via hydrogen tech & scrap-based EAFs

🛠️ Steel Demand Outlook Revised Upward to 9% for FY25

➤ Supported by infra, housing, and railway allocations in Union Budget

➤ SME & MSME growth in semi-finished and long steel continues strong

📊 SteelBazaar Insights: Data-Driven Trends

Segment Trend Insight

TMT Bars 🟡 Stable Minor regional fluctuations; no price shock

HR Coils 🟡 Stable Balanced inventory in Raipur, Ahmedabad

Scrap 🟡 Stable Range ₹30K–₹37K; demand holding in Ludhiana

Exports 🔻 Down Pressure from EU + ASEAN steel oversupply

Imports 🔺 Up Influx from China, Korea prompting duties

🌍 Global Angle

EU reduces steel import quota by 15%

USA reinstates 25% tariff on Chinese steel

China’s output continues to surge, adding global pressure

🧩 SteelBazaar Recommendation

Sellers should maintain price discipline and watch global dumping risks. Buyers are advised to secure short-term contracts before Q2 volatility sets in.

Also Read : South India’s Steel Sector: Rising Output, Shrinking Inputs Steel Market Price Trends: Analysts Predict Recovery in HRC & Rebar Prices