India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

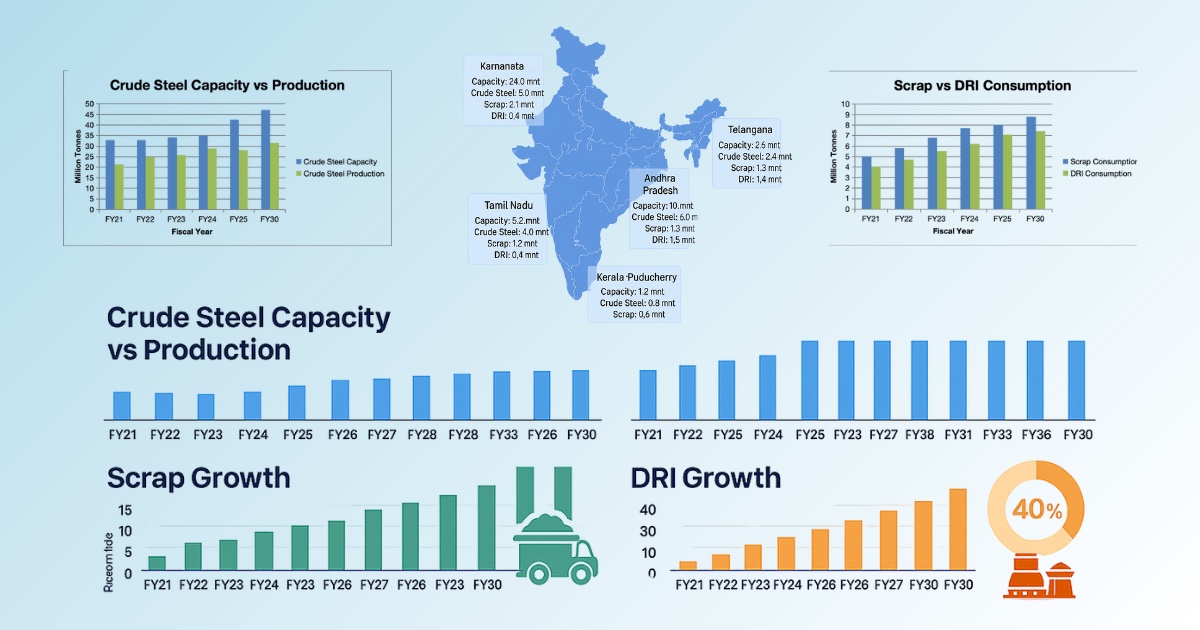

South India stands at the threshold of a transformational steel boom—but supply-side fundamentals, particularly scrap availability, are not keeping pace. According to recent statistics, the crude steel capacity in the region is expected to reach 47.2 million tonnes (mnt) by FY30, but raw material availability continues to be a key weakness, especially in Tamil Nadu.

Production vs Capacity – Widening Gap

Fiscal Year Crude Steel Capacity (mnt) Crude Steel Production (mnt)

FY21 32.8 21.4

FY25 42.5 28.2

FY30 (Est.) 47.2 31.6

Though there is a 44% increase in capacity over the last decade, utilization of output is not keeping pace proportionally—implying supply chain, logistics, and energy cost impediments at plant levels.

♻️ Scrap & DRI: Demand Closing in on Supply

Fiscal Year Scrap (mnt) DRI (mnt)

FY21 5.0 4.0

FY25 8.0 7.1

FY30 (Est.) 8.8 7.4

With both scrap and DRI use reaching saturation points, any future spurt in output may precipitate material shortages unless upstream capacity is increased as well.

State-wise Steel Snapshot

State Capacity Crude Steel Srap DRI

Karnataka 24.0 mnt 15.0 mnt 2.1 mnt 3.4 mnt

Tamil Nadu 5.2 mnt 4.0 mnt 1.2 mnt 0.4 mnt

Andhra Pradesh 10.0 mnt 6.0 mnt 1.3 mnt 1.5 mnt

Telangana 2.6 mnt 2.4 mnt 1.3 mnt 1.4 mnt

Kerala + Puducherry 1.2 mnt 0.8 mnt 0.6 mnt 0.4 mnt

Tamil Nadu, which has 30–35 operational mills, is most susceptible to structural scrap deficiencies, particularly because it has no large-scale local sponge iron or scrap yards.

Bottlenecks in Scrap Supply

Fragmented Collection: The majority of industrial scrap originates from micro-clusters in Chennai, Coimbatore, and Hosur.

Seasonal Disruption: Monsoon delays, festival shutdowns, and logistics chokepoints significantly impact volumes.

Import Volatility: Port-based importers in Chennai are subject to 45–50 day lead times from Europe/US with high freight risk.

Expert Insights

Capacity Underutilization will expand unless southern states make investments in input security and power reforms.

Scrap Ecosystem Modernization—centrally located yards, scrap auctions, and traceability—needs to be given a high priority.

Tamil Nadu Urgently Needs to Diversify in its raw material procurement—be it through import terminals, pellet route, or long-term DRI contracts.

What Industry Needs to Do Next

✅ Mill Owners: Secure long-term agreements with scrap processors or opt for integrated backward linkages.

✅ Govt & Policy Bodies: Launch incentives for digital scrap procurement and intra-state scrap corridors.

✅ Traders & Sourcing Heads: Establish agile vendor networks and book ahead imports during lean-freight periods.

The SteelBazaar Advantage

Live Scrap Listings — Verified suppliers, real-time prices

Digital Contracts — Guaranteed volumes, no paperwork

SB Instafin — Procurement working capital instantly

SB Logistics — South India priority freight

Closing Note by the Expert

I have two decades of experience in the industry and have never witnessed so robust a disconnect between ambition to produce steel and planning for scrap supply. South Indian mills require more than capacity—more resilience.

Tune in for more each week. For bespoke reports, contact SteelBazaar Intelligence.

Also Read : Global Steel Industry Outlook: Moderate Growth Amidst Demand Gaps & Price Recovery SteelBazaar Monthly Recap – March 2025 Edition