India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

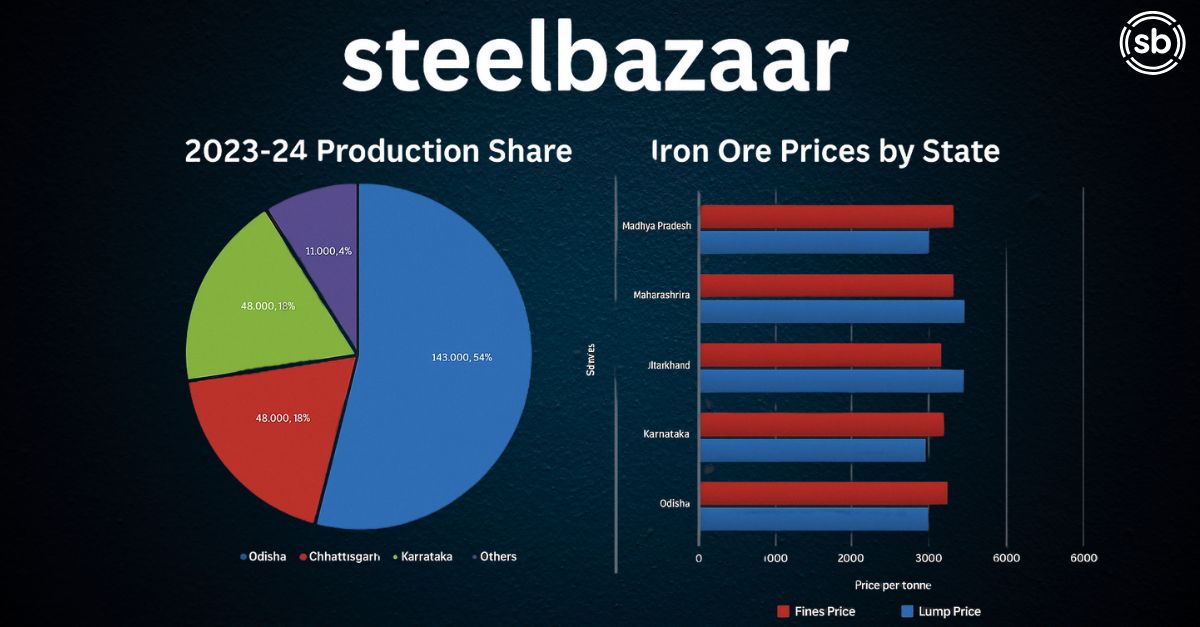

India’s iron ore production for FY 2023–24 stands at 262 million tonnes, with Odisha alone accounting for 54% of it. This SB Special decodes production volumes, state-wise price variations, and shifting market shares.

Iron Ore Prices by State

Prices of lump ore are consistently higher than fines across all states.

Jharkhand shows the highest differential, with lump prices nearing ₹6,500/tonne, indicating high-quality ore and logistics premium.

Odisha offers more balanced pricing for both fines and lumps, keeping it attractive for bulk procurement.

State-wise Production (2021–22 vs 2023–24)

Odisha’s production grew from 136 MT to 142 MT, reinforcing its supremacy.

Chhattisgarh and Karnataka remain closely matched at 43 MT and 41 MT, respectively.

Jharkhand’s production has stagnated near 25 MT, raising concerns about regulatory and mining bottlenecks.

Production Share – FY 2023–24

Odisha: 54% share

Chhattisgarh & Karnataka: Combined 32%

Jharkhand: 10%, despite rich reserves

Others: 4% contribution, slowly rising due to expanded activity in Maharashtra, MP, and Goa

🔍 SB Intelligence – What This Means for the Industry

Odisha is set to retain its leadership due to sustained output and cost-effective pricing.

Price variations could influence where steelmakers and pellet plants source their feedstock.

States like Maharashtra and Madhya Pradesh are emerging players in pricing competitiveness.

Jharkhand, once a powerhouse, may need policy or infrastructure reform to reclaim share.

📢 Coming Soon on SB News:

A deep dive into logistics impact on ore pricing and how steel demand is reshaping mine economics.

Also Read : India’s NMDC Steel Surpasses 2 Million MT Crude Steel Output SB Special: Sustainable Steel Is the Future — Be Ready!