India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

Global Market Signals + 🇮🇳 Indian Price Trends = Key Forecasts

As we close out March 2025, both domestic and global indicators are offering crucial cues for the Indian steel industry.

🔍 Key Observations:

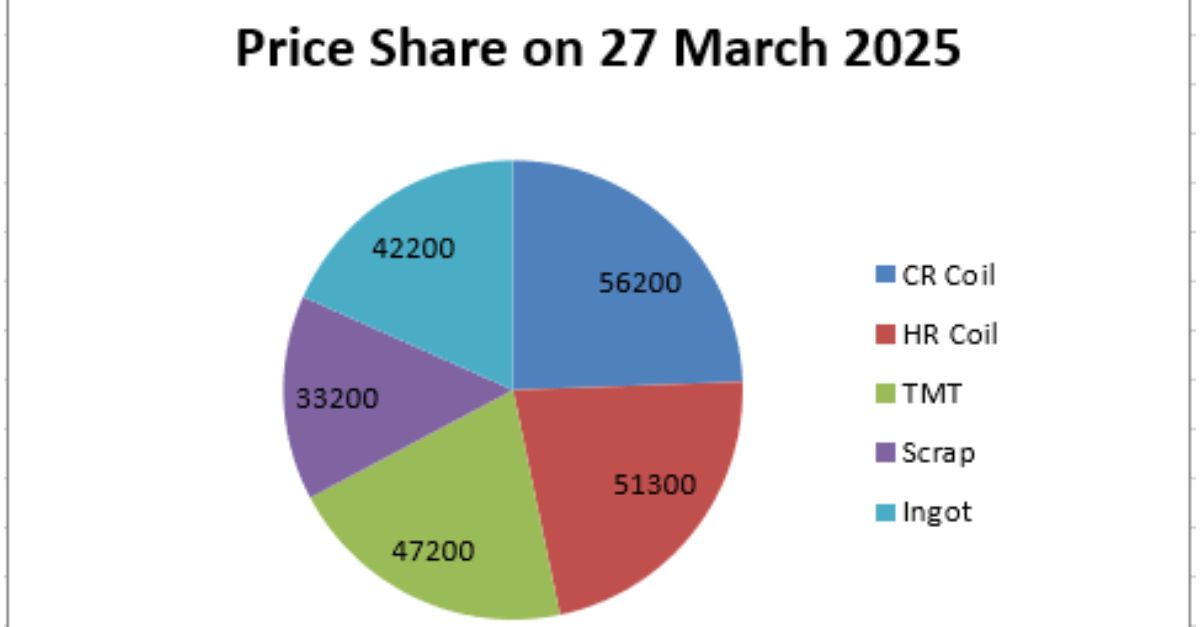

Flat steel products (CR/HR Coil) have shown consistent stability throughout March with negligible fluctuations. CR Coil hovered between ₹53,000–₹58,000 PMT, while HR Coil remained firm around ₹47,000–₹52,500 PMT.

Scrap prices remained within a narrow band of ₹30,000–₹37,700 PMT, suggesting steady secondary steel production.

TMT Bar prices have been largely range-bound (₹45,000–₹50,000 PMT), indicating balanced demand from infrastructure and construction sectors.

Ingot and Billet prices stayed in the ₹41,000–₹44,500 PMT zone, confirming production costs are not seeing upward pressure for now.

🌍 Global Backdrop:

China continues to flood the global market with excess steel, pressuring global steel benchmarks.

EU and US have responded by reducing quotas and reinstating tariffs, respectively.

These measures are creating a bifurcation—cheap imports on one side and protected domestic pricing on the other.

📊 What This Means:

With global oversupply and tightening trade barriers, Indian exporters may feel the heat, but domestic manufacturers may benefit due to lesser import disruptions.

Stable domestic prices, as seen in the charts, signal inventory balance and no near-term inflation, especially in long and flat products.

However, this stability might be short-lived if protectionist policies gain momentum and global prices begin to spike.

🔮 SteelBazaar Forecast:

Expect mild price hardening in Q2 FY25 for CR/HR coils due to policy moves and restocking ahead of peak demand season.

TMT and Ingot/Billet prices may stay range-bound unless government pushes infra projects aggressively.

Scrap price stability suggests a reliable base for EAF players, but rising logistics costs may pressure margins.

✅ SteelBazaar Recommendation:

Audience - Actionable Insights

Buyers - Lock-in current rates via short-term contracts; consider hedging via bulk purchases

Sellers - Avoid undercutting – prices are stable, and domestic demand is expected to rise

Traders - Monitor global cues (esp. China and EU), and prepare for price revision windows post-April

Investors - Keep an eye on policy announcements (safeguard duties, infra allocation updates) in Q1 FY26

Also Read : SB Special | Structural Steel: Building the Backbone of Global Growth SB Special Insight – Global Steel Demand by Sector (2024)