India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

India’s pellet export market has turned quiet, with suppliers preferring the domestic route due to stronger margins and steady demand at home.

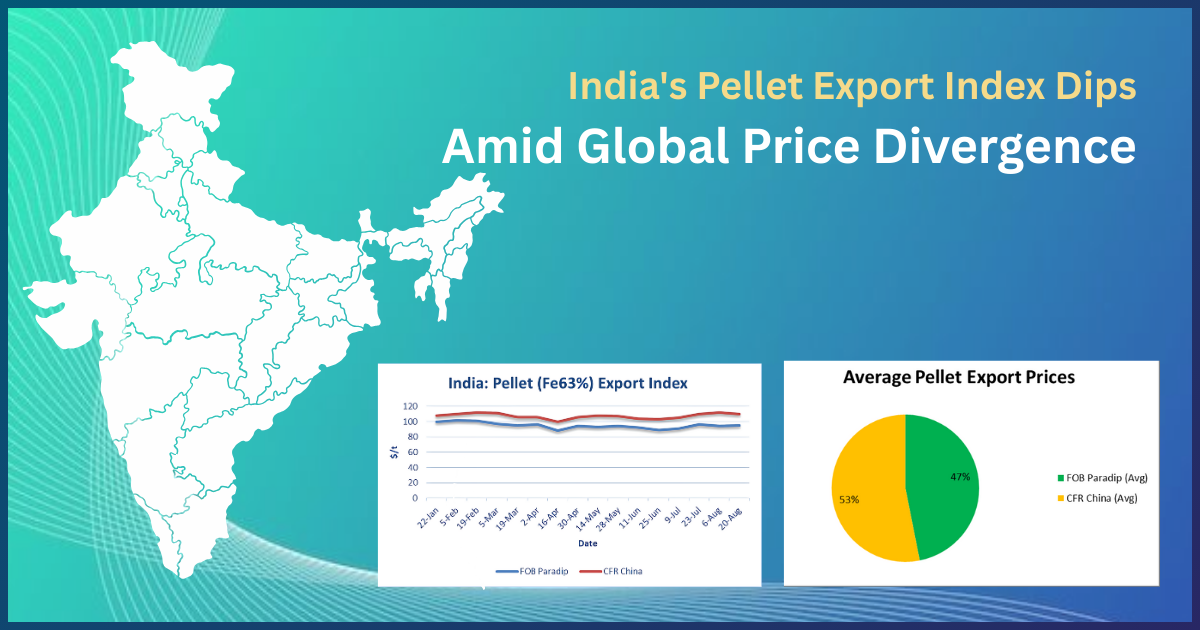

The pellet export index (Fe 63%, 3–3.5% Al) dropped by $1/tonne week-on-week, settling at $97/t FOB east coast as of August 20, 2025. Despite this decline, suppliers are reluctant to close export deals, as domestic prices are delivering higher returns.

Tight availability of iron ore has pushed up pellet production costs, further discouraging exports. Indian producers are currently focused on catering to domestic steelmakers, where demand remains consistent and profit margins are more attractive.

Market participants report minimal export activity as overseas buyers are unwilling to match Indian offers. This pricing gap has resulted in a slowdown in trade, with no confirmed pellet export deals reported recently.

Unless international prices pick up or domestic supply pressures ease, Indian pellet exports are likely to remain muted. For now, robust local demand continues to anchor supplier priorities within India.

Also Read : Steel Index On Steady Mode as Raw Material Prices Rise Decoding the Future of Global Steel Demand: India to Lead Consumption