India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

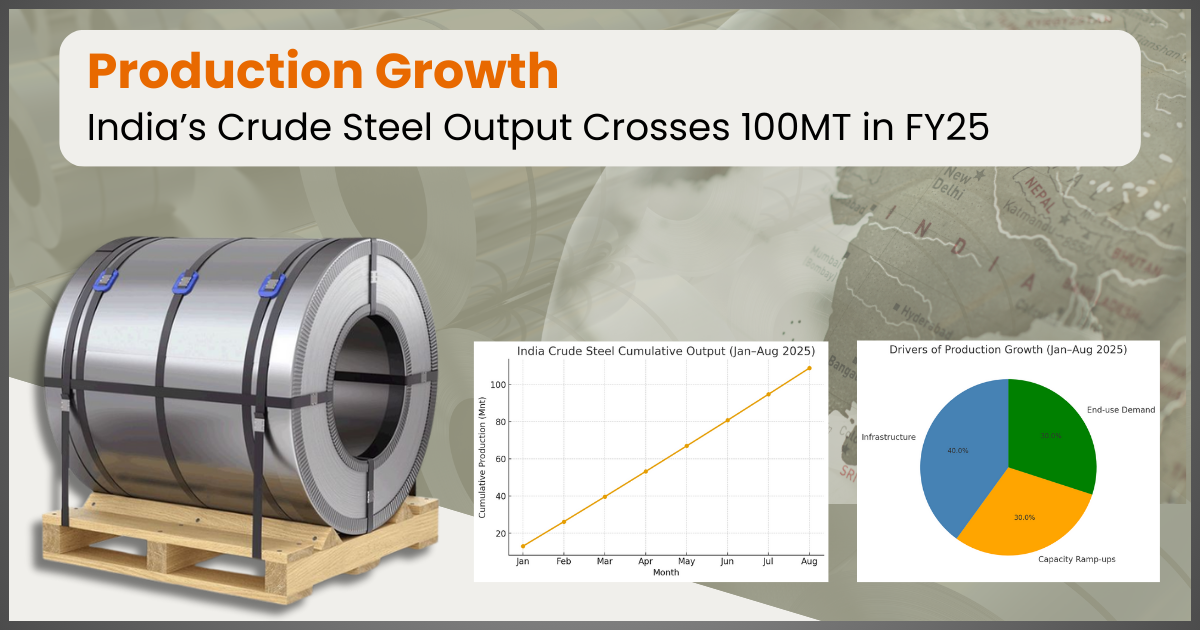

India’s crude steel production surpassed 100 million tonnes in Jan–Aug 2025, signalling strong operational momentum and resilient domestic demand.

Infrastructure push: Public capex and housing activity kept mills running at high utilization.

Capacity ramp-ups: Brownfield debottlenecking and smoother plant availability at large producers.

Diverse end-use demand: Construction, autos, and capital goods supported steady offtake.

India consolidates its position as the world’s #2 steel producer, narrowing the gap with the leader even amid global demand uncertainty and price volatility.

Input costs: Coking coal and energy price swings may pressure spreads.

Imports & global prices: Cheaper overseas offers could weigh on domestic realizations.

Export appetite: External demand will influence mill run-rates and product mix.

If current run-rates sustain into the festive and post-monsoon build season, full-year 2025 output is on track for a new peak, with pricing and margins hinging on input costs and import competition.

Also Read : India’s Coated Steel Market Under Pressure, Eyes Festive Recovery South Asia’s Imported Scrap Market Faces Seasonal Slowdown