India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

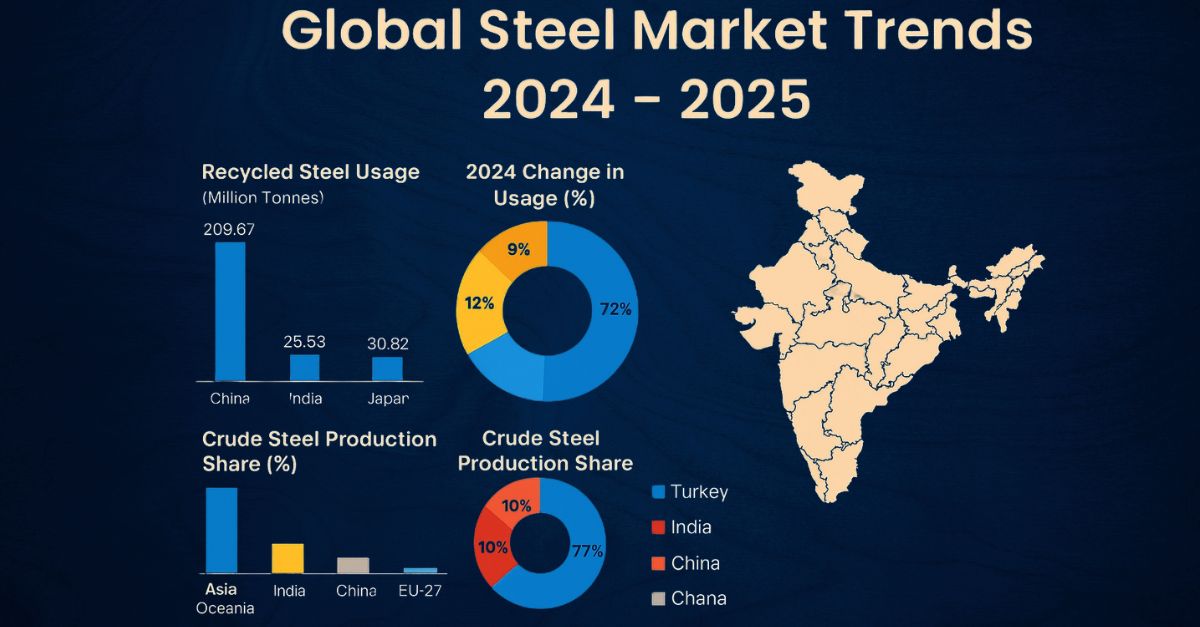

Discover steel recycling trends across key countries like China, India, the USA, and Turkey in 2024. Explore usage volumes, sustainability benchmarks, and their strategic implications.

♻️ Who Leads the World in Recycled Steel Usage in 2024-25?

As sustainability and decarbonization define the future of steel, recycled steel usage has become a critical metric of green progress. In 2024, global leaders like China, the EU, the USA, and Turkey showed sharp contrasts in how they integrate scrap steel into their production.

According to the latest data, global recycled steel consumption surpassed 450 million tons, with notable shifts in volume and share across regions.

🌎 Country-Wise Recycled Steel Usage 2024-25

Rank Country/Region Recycled Steel Usage (MMT) Share of Crude Steel Production YoY Change

1 China 209.67 20.9% ▼ 1.9%

2 EU-27 76.64 59.2% ▲ 1.9%

3 USA 55.30 69.2% ▼ 3.0%

4 Turkey 31.27 84.8% ▲ 7.5%

5 Japan 30.82 36.7% ▼ 3.2%

6 India 25.53 23.0% ▲ 7.5%

7. South Korea 22.51 35.4% ▼ 14.0%

Source: Global Steel Recycling Report, 2024-25

🔍 Key Observations:

China leads in volume but lags in recycling share due to its BOF-heavy infrastructure.

Turkey stands out with 84.8% of its steel made from scrap—thanks to widespread use of electric arc furnaces (EAF).

India and the EU show positive growth, driven by policy mandates and EAF investments.

South Korea’s sharp 14% decline suggests supply chain disruptions or cost pressures on scrap imports.

🔧 Strategic Impact on Global Steel Sustainability:

As the world transitions toward green steel, countries prioritizing scrap usage will have a competitive edge—both economically and environmentally. Nations with high EAF adoption, like the USA and Turkey, are setting the standard, while others must scale scrap integration to meet climate targets.

Stakeholders across the steel value chain—especially recyclers, mills, service centers, and policymakers—must closely monitor scrap availability, regulatory changes, and technology shifts shaping green steel production.

🧠 The SteelBazaar Advantage:

SteelBazaar empowers steel professionals with real-time access to:

25,000+ listed SKUs across scrap and finished steel

Smart quotation tools and marketplace analytics

Verified sellers with sustainable sourcing options

Whether you're a trader, manufacturer, or EPC contractor, leverage SteelBazaar for efficient, sustainable, and transparent procurement.

📌 Stay ahead of the curve with SB News Portal—your trusted source for global steel trends, sustainability insights, and recycling data.

Also Read : SB Special | Structural Steel: Building the Backbone of Global Growth South India’s Steel Sector: Rising Output, Shrinking Inputs