India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

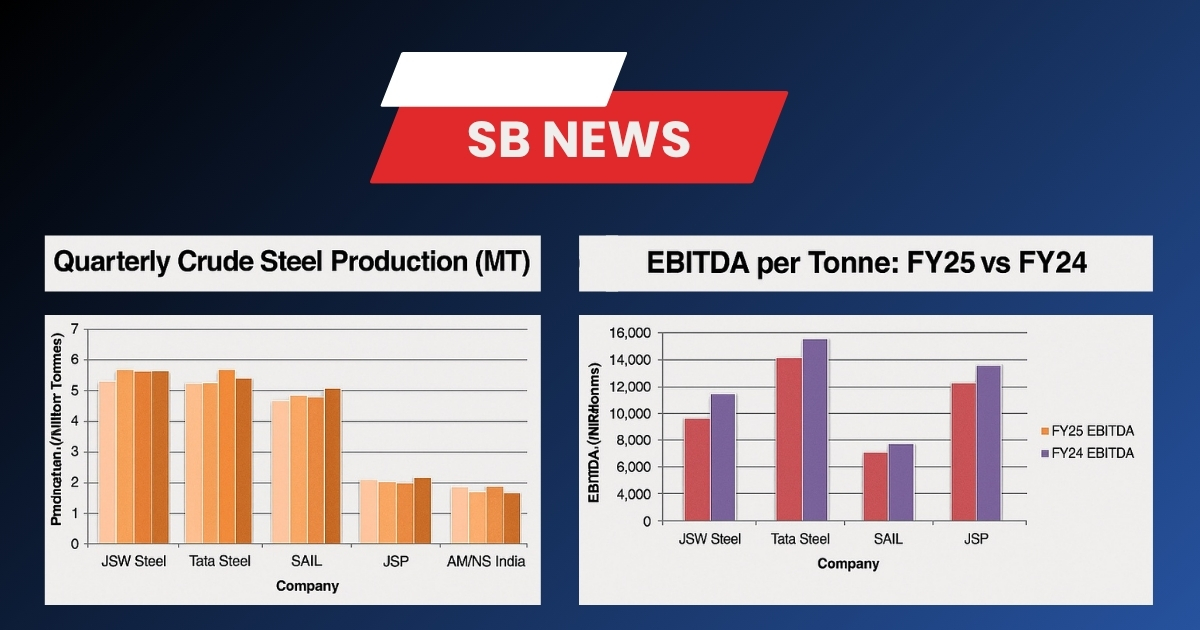

Indian primary steel producers entered FY25 under pressure, with EBITDA plunging year-on-year across major players. According to SteelBazaar’s review of Q4 FY24 and early FY25 data, sluggish demand, falling steel realizations, and rising input costs have eroded margins significantly.

Key Stats (FY24 Q4 vs FY25 Q1 Estimates)

Metric Q4 FY24 FY25 Q1 Est. Trend

Avg EBITDA/Tonne ₹6,000–₹7,000 ₹3,000–₹4,500 ▼ Downtrend

Domestic Steel Demand Flat Mild Growth ➡️ Stable

Exports (YoY) -18% -5% to -8% ▲ Recovering

Coking Coal Prices (avg.) $270/tonne $220–$230 ▼ Eased

While coking coal costs have moderated, they weren’t enough to offset weak realizations. Flat domestic demand and global price pressures kept mills from fully utilizing capacity, especially in the longs segment.

Key Observations

EBITDA Compression: JSW Steel, Tata Steel, and SAIL all saw operational margins shrink due to weaker price realizations and steady fixed costs.

Utilization Dips: Long product-focused mills are operating at reduced capacity due to tepid infra demand.

Export Outlook: Mild recovery signs in export orders from the Middle East and SE Asia offer hope for FY26.

Cost Relief: Input prices—especially coking coal—are easing, which could lift margins if demand recovers.

Strategic Impact for Buyers & Sellers

Buyers: Expect price stability or slight correction in the short term—ideal window to secure inventory.

Sellers: Margin pressure will force sellers to optimize cost structures and explore exports more aggressively.

🔧 The SteelBazaar Advantage

Stay ahead with SteelBazaar’s real-time price dashboards, mill insights, and AI-driven RFQ tools. Whether you’re buying or selling, our platform ensures smarter decisions during uncertain times.

📬 Stay Updated

For weekly steel insights, trends, and pricing reports — subscribe to SB News or follow us on WhatsApp.

Also Read : SB Special: Sustainable Steel Is the Future — Be Ready! SteelBazaar Special Insight: Alloy Steel Market – 2025 Edition