India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

Prices of Steel

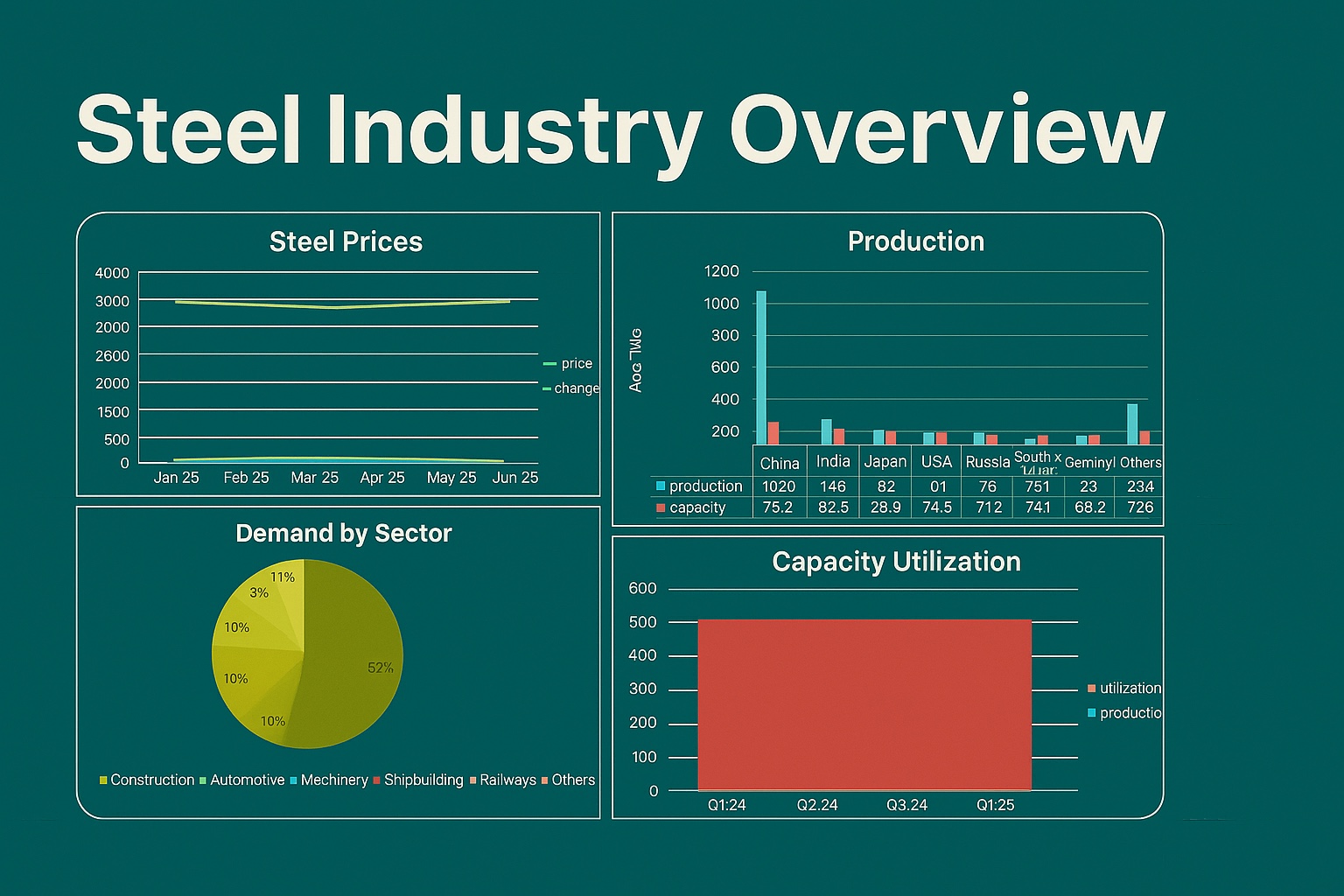

Following a trend of softening in early 2025, prices bounced back in April and May, going up from ₹3180/tonne in March to ₹3280/tonne by May. Prices as of June stand at ₹3310/tonne with a modest 0.9% increase—reflecting cautious optimism following market recalibration.

Production & Capacity

China remains the world's leading steel producer at 1020 million tonnes, well ahead of India with 140 MT. Importantly, India has the highest capacity utilization of 82.5%, surpassing Japan (78.3%) and USA (74.8%), indicating effective usage in the face of the globally reported oversupply situation.

Demand Dynamics

Construction continues to be the biggest steel-consuming industry, accounting for 52% of overall demand and expanding at 4.2%. Machinery (16%) and Automotive (12%) are second and third, with automotive experiencing a -2.1% decline—presumably due to EV transition issues.

Utilization Outlook

Capacity utilization has slowly decreased from 77.3% in Q1 24 to 74.8% in Q1 25, tracking global demand unpredictability and increasing idle capacity, predominantly in the US and Europe.

Key Observations

Mild price uptick indicates market stabilization.

India's steel mills are most efficiently utilized among large economies.

Energy sector indicates highest demand growth at 8.5%, highlighting infrastructure transformations.

Automotive steel demand weakness indicates sectoral headwinds.

Strategic Advantage for Buyers & Sellers

Buyers: Secure procurement now before additional price increases.

Sellers: Target high-growth industries such as energy and construction.

Investors: Track utilization efficiency as a key gauge of sectoral strength.

The SteelBazaar Advantage

Connect effortlessly with authenticated sellers, compare real-time prices, and receive instant quotes custom-made to your precise specs—all within one AI-driven B2B steel marketplace.

Also Read : South India’s Steel Sector: Rising Output, Shrinking Inputs Global Steel Industry Outlook: Moderate Growth Amidst Demand Gaps & Price Recovery