India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

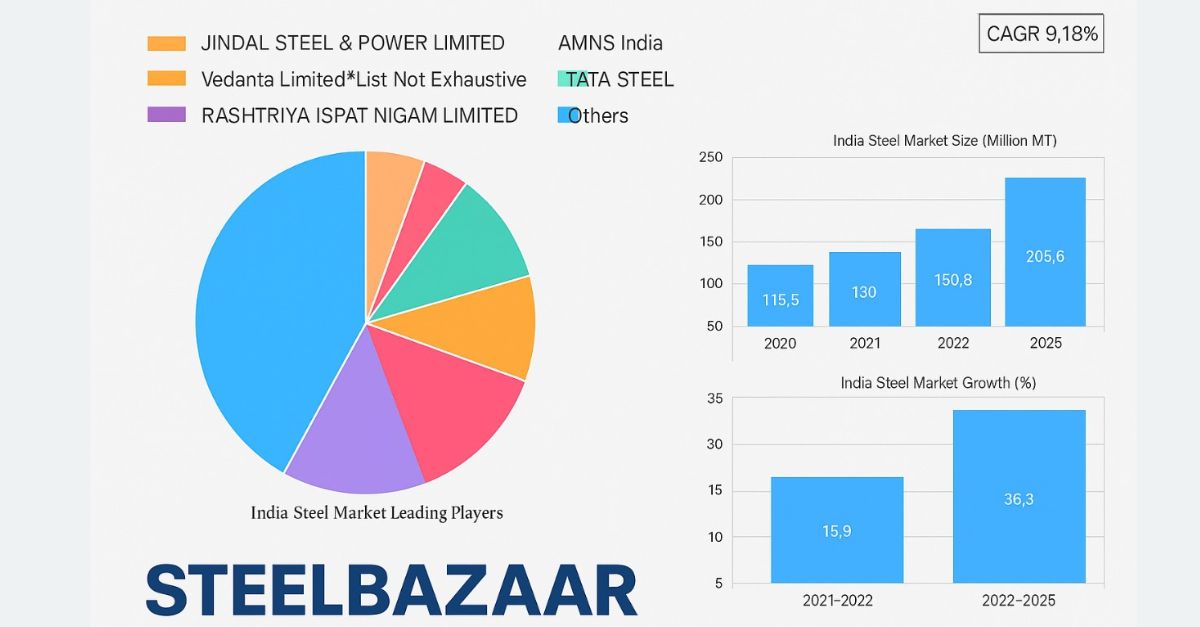

India’s steel industry continues to show impressive momentum, with market size expected to reach 205.6 million metric tonnes by 2025, up from 115.5 million MT in 2020—reflecting a strong CAGR of 9.18%.

🔹 Steel Market Size (2020–2025)

2020: 115.5 MT

2021: 130 MT

2022: 150.8 MT

2025 (Projected): 205.6 MT

This growth is driven by major infrastructure investments, automotive expansion, and the adoption of next-gen steel technologies.

🔹 Year-over-Year Growth

2021–2022: 15.9%

2022–2025: 36.3%

These figures highlight accelerated demand post-2022 as supply chains recover and industrial demand surges.

🔹 Leading Market Players

India’s steel market is led by a mix of private and public giants. Here's the estimated market share breakdown:

Tata Steel – 15%

Rashtriya Ispat Nigam Limited – 14%

AM/NS India – 12%

Jindal Steel & Power – 10%

Vedanta Limited – 9%

Others – 40%

💡 What It Means

With increasing demand, players are focusing on digital transformation, sustainable production, and capacity expansion. SteelBazaar continues to empower stakeholders by offering real-time data, procurement tools, and seamless B2B solutions for the evolving Indian steel market.

Stay tuned for weekly price updates, trend forecasts, and expert analysis—only on SteelBazaar.

Also Read : Macron’s India Visit Deepens Alliance Steel & Raw Material Price Trends in FY'25: What Drove the Market?