India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

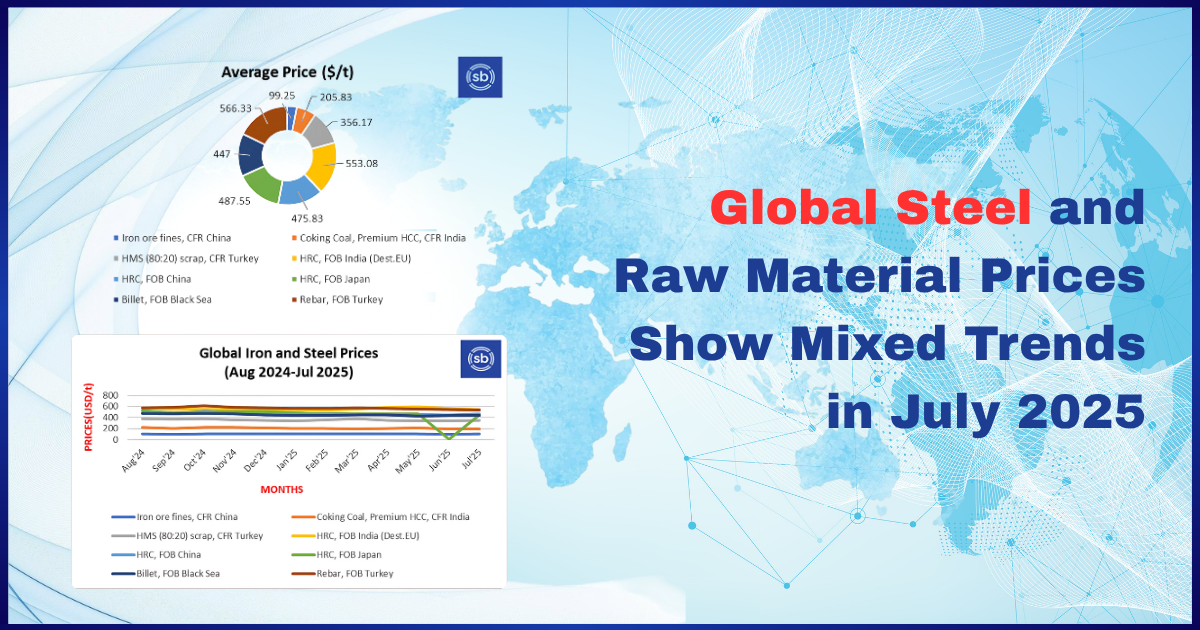

The global steel and raw materials market saw uneven pricing trends in July 2025, reflecting shifting demand and economic uncertainties. While some segments gained modest ground, overall momentum remained weak.

Iron ore prices showed a slight recovery, driven by improved buying activity in China and favorable sentiment in futures markets. However, average prices stayed below $100 per tonne, indicating fragile market confidence.

Hot-rolled coil (HRC) export offers from China increased by around $19 per tonne compared to June. This rise was supported by higher domestic futures and expectations of policy changes to boost industrial demand.

Turkey’s deep-sea scrap prices also strengthened, buoyed by consistent demand from construction and improved purchasing activity. In contrast, Indian HRC export prices to the EU dropped sharply to approximately $541 per tonne FOB, pressured by weak European demand and rising global competition.

Despite these mixed results, market sentiment is cautiously optimistic heading into August. Industry players are watching for signs of stabilization, with hopes pinned on policy support and seasonal demand recovery to drive a more consistent rebound.

Also Read : International intrigue in Vietnam's rare earth Global Steel Output: Flat Overall, Diverging by Region (Aug 2025)