India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

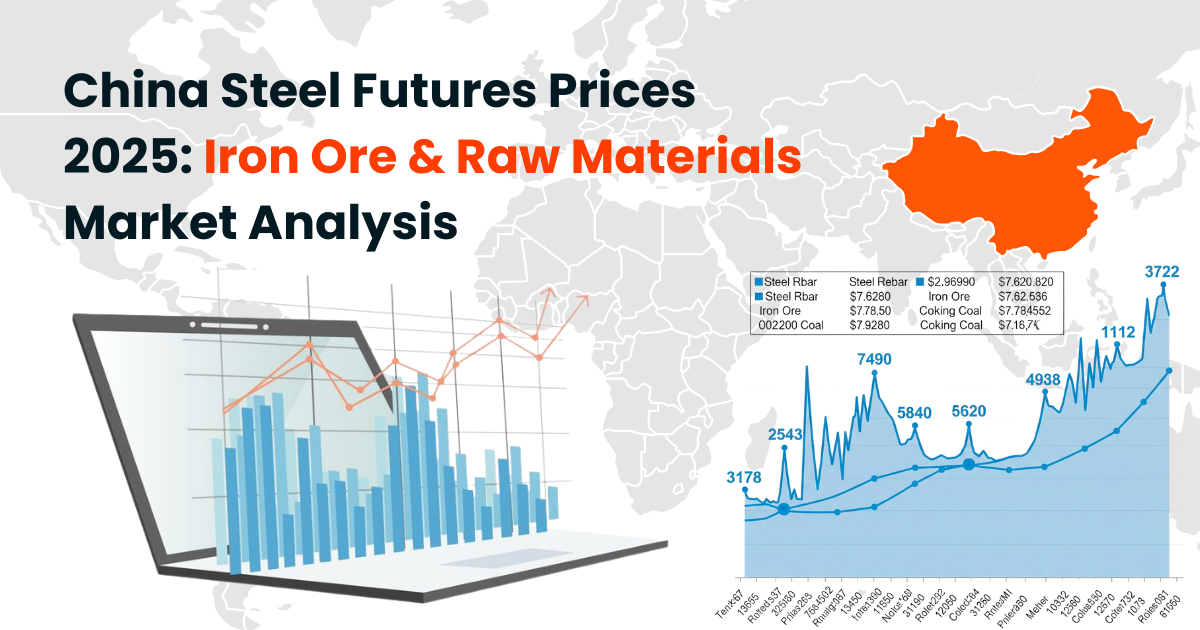

China's steel and raw material futures markets continue to face significant headwinds in 2025, with declining prices across key commodities reflecting broader economic challenges and shifting demand patterns.

Steel prices in China reached 3104 CNY/T on July 11, 2025, showing a modest monthly gain of 5.83% despite remaining 5.91% lower than the previous year. The market demonstrates ongoing volatility as the industry grapples with capacity surpluses and weakening construction demand.

Steel prices in 2025 are still expected to have some room for further decline, according to market analysts. This bearish outlook stems from persistent oversupply conditions and reduced domestic consumption, particularly in China's construction sector.

Iron ore futures have experienced notable pressure, with prices falling to $95.32 USD/T on July 9, 2025, down 12.34% compared to the same period last year. This decline aligns with forecasts suggesting iron ore prices expected to fall by 13-14% in 2025 to $95/t due to high raw material reserves and possibly oversupply.

China's steel output is forecast to fall below 1 billion tonnes in 2025 due to weak construction demand, indicating structural challenges that may continue pressuring future prices. Trade uncertainities and global economic headwinds add additional complexity to price forecasting.

The Chinese steel and raw materials futures market remains in a transitional phase, with price movements closely tied to domestic demand recovery and global trade dynamics. Investors should monitor construction sector indicators and government policy changes for directional cues.

Also Read : Low winter demand and abundant supply keep LNG spot prices low Shanxi orders coal miners to cut production, sparks rally in futures