India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

India’s steel market has entered a correction phase, with domestic prices sliding to their lowest level in five years. According to BigMint, Hot Rolled Coil (HRC) prices dropped to around ₹47,150 per tonne, while rebar hovered near ₹46,500–47,000 per tonne. The decline is driven by subdued construction activity, lower global demand, and a rise in cheaper imports.

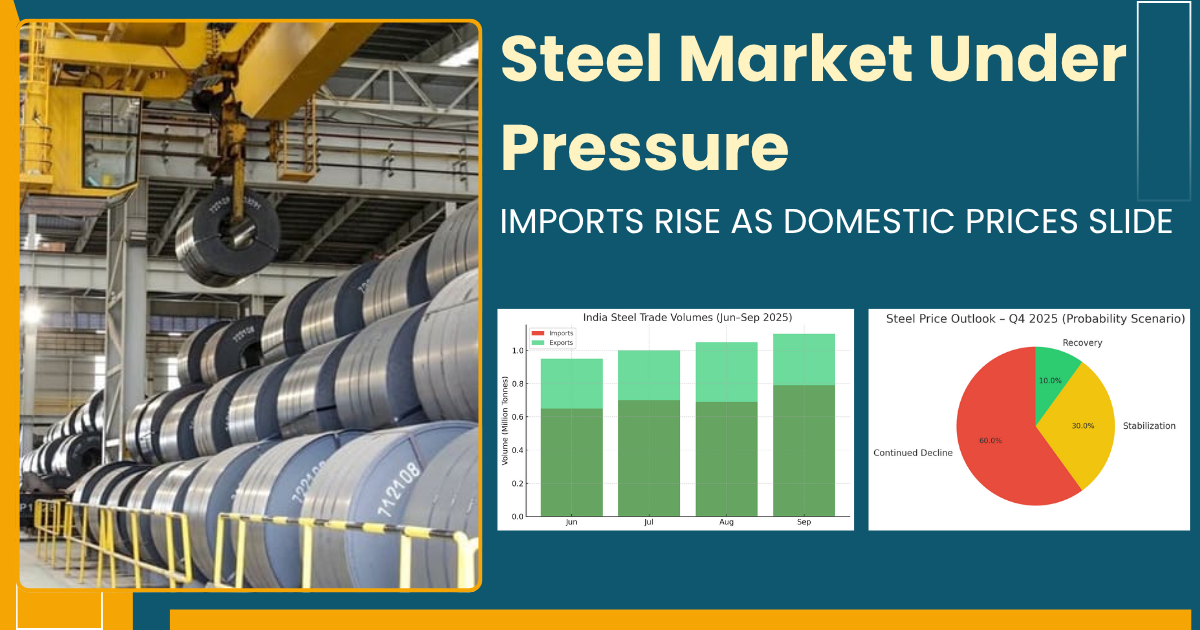

Steel imports rose to 0.79 million tonnes in September 2025, compared to 0.69 million tonnes a month earlier, reflecting increased inflows from countries like China and Vietnam. On the export front, shipments climbed 40% year-on-year to 4.43 million tonnes, though India remained a net importer during the period.

Iron ore prices stayed firm at ₹4,800–₹5,000 per tonne, while coking coal held steady near $205/t CFR, keeping mill margins tight. Despite steady input costs, sluggish end-user demand has limited pricing flexibility for producers.

Analysts expect steel prices to remain under pressure through Q4 2025, with potential stabilization only if mills initiate production cuts or demand picks up post-festive season.

Also Read : Decoding the Future of Global Steel Demand: India to Lead Consumption Steel Index On Steady Mode as Raw Material Prices Rise