India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

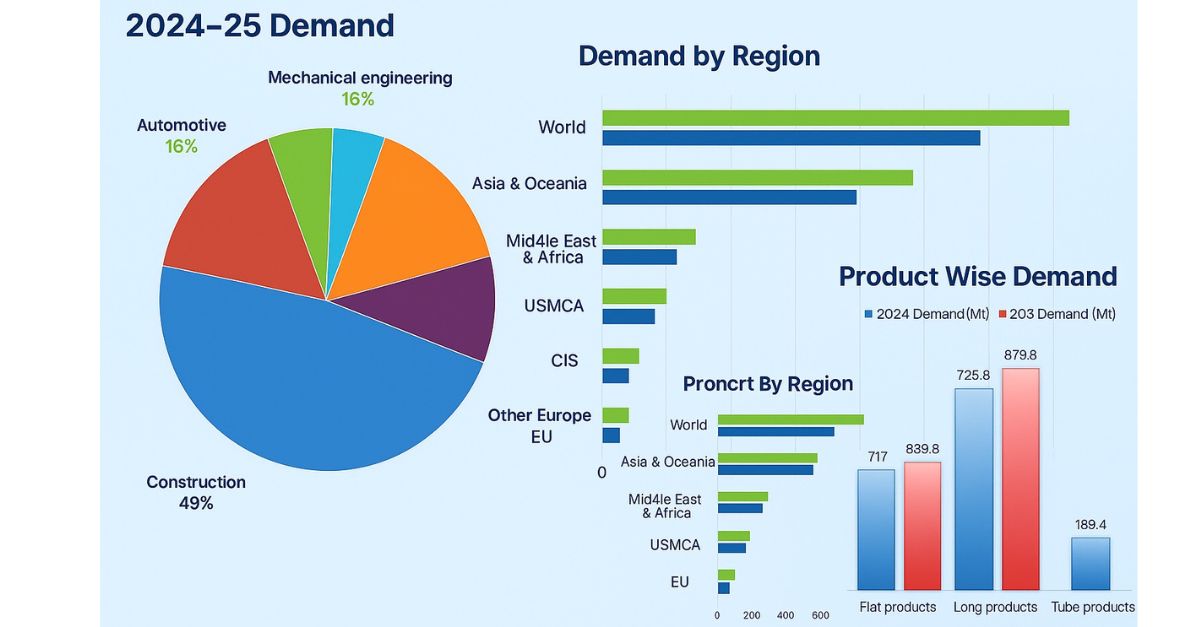

This sector-wise breakdown reveals where the 1793 Mt global steel demand is concentrated, helping you align strategy with market priorities.

Sector-Wise Steel Demand Breakdown:

Sector 2024 Demand (Mt) % Share

Construction 877 49%

Mechanical Engineering 290 16%

Automotive 134 8%

Other Transport 63 4%

Domestic Appliances 61 3%

Metal Products 204 11%

Oil & Gas 113 6%

Defence 16 1%

Miscellaneous 34 2%

🧠 Industry Insight & Strategic Takeaways:

🏗️ 1. Construction (49%)

Dominates global demand with urbanization, housing, infrastructure, and commercial real estate projects.

Key steel products: TMT bars, structural beams, pipes, and galvanized coils.

SteelBazaar Suggestion:

Launch category-specific storefronts (like “Infra Steel Hub”), bundle project-ready steel SKUs, and provide live quote functionality for EPC contractors.

2. Mechanical Engineering (16%)

Strong demand from HVAC, elevators, manufacturing machines, and energy systems.

Requires precision and certified steel grades (HR, CR, special alloys).

SteelBazaar Suggestion:

Enable SB SmartTrade filters by grade and thickness. Create a lead-routing module that connects OEMs with certified suppliers through SB LeadX.

3. Automotive (8%)

Growth driven by EV transition, lightweighting, and global auto production recovery.

Demand for CR, galvanized, high-strength steel.

SteelBazaar Suggestion:

Promote on-platform auto-grade-certified steel, with traceability and mill test certifications. Allow OEMs to post technical RFQs directly via SB Vendor Desk.

4. Other Transport (4%)

Covers railways, shipping, heavy vehicles—capital-intensive and schedule-sensitive.

Prioritizes long products like rails, plates, and forged sections.

SteelBazaar Suggestion:

Use SB SmartQuote to enable milestone-based bidding (ideal for phased delivery projects). Allow state-owned enterprises and PSUs to run tenders via SB Infra Connect.

5. Domestic Appliances (3%)

Stable yet growing segment; needs aesthetic, corrosion-resistant flat products.

High volume, low margin—requires precise pricing and packaging.

SteelBazaar Suggestion:

Use auto-reorder logic for appliance manufacturers to maintain just-in-time inventory with custom packaging needs. Enable branding and bulk discount support.

6. Metal Products (11%)

Broad category: wire, fasteners, containers, furniture, fencing, and fabrication.

Demand is highly fragmented and distributed across SMEs.

SteelBazaar Suggestion:

Deploy SB MicroProcure—a procurement tool for micro manufacturers to find price-optimized small lots. Recommend bulk conversion deals to encourage standardized sourcing.

7. Oil & Gas (6%)

Relies on seamless pipes, high-pressure-grade plates, corrosion-resistant steel.

Often project-based and requires approvals and QA.

SteelBazaar Suggestion:

Provide QA-compliant sourcing bundles integrated with documentation tools. Highlight vendors with API/ISO certifications on profiles.

8. Defence (1%)

Niche segment; uses high-grade, ballistic-resistant, naval-grade steel.

Long procurement cycles, stringent compliance.

SteelBazaar Suggestion:

Use SB GovTrade interface to simplify onboarding and vendor visibility for government contracts. Allow onboarding of DRDO/DPSU-approved suppliers.

Summary:

Steel demand is evolving from just volume to value + velocity. Segments like mechanical engineering and automotive demand tech integration and certification, while construction and infrastructure crave bulk fulfillment speed.

SteelBazaar’s Role in 2024 and Beyond:

SteelBazaar is not just a marketplace—it is a supply intelligence engine that matches industrial steel demand with quality vendors through:

🔍 Verified supplier discovery

🧠 AI-led SmartTrade & SmartQuote

📦 Bundled steel solutions

💬 Instant RFQs & digital negotiation

📊 Sector-based insight dashboards

Also Read : Protests Erupt as Baldota Group’s BSPL Project Continues Despite CM’s Orders Tata Steel Tubes Division Achieves 1 Million Tonne Milestone in FY25