India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

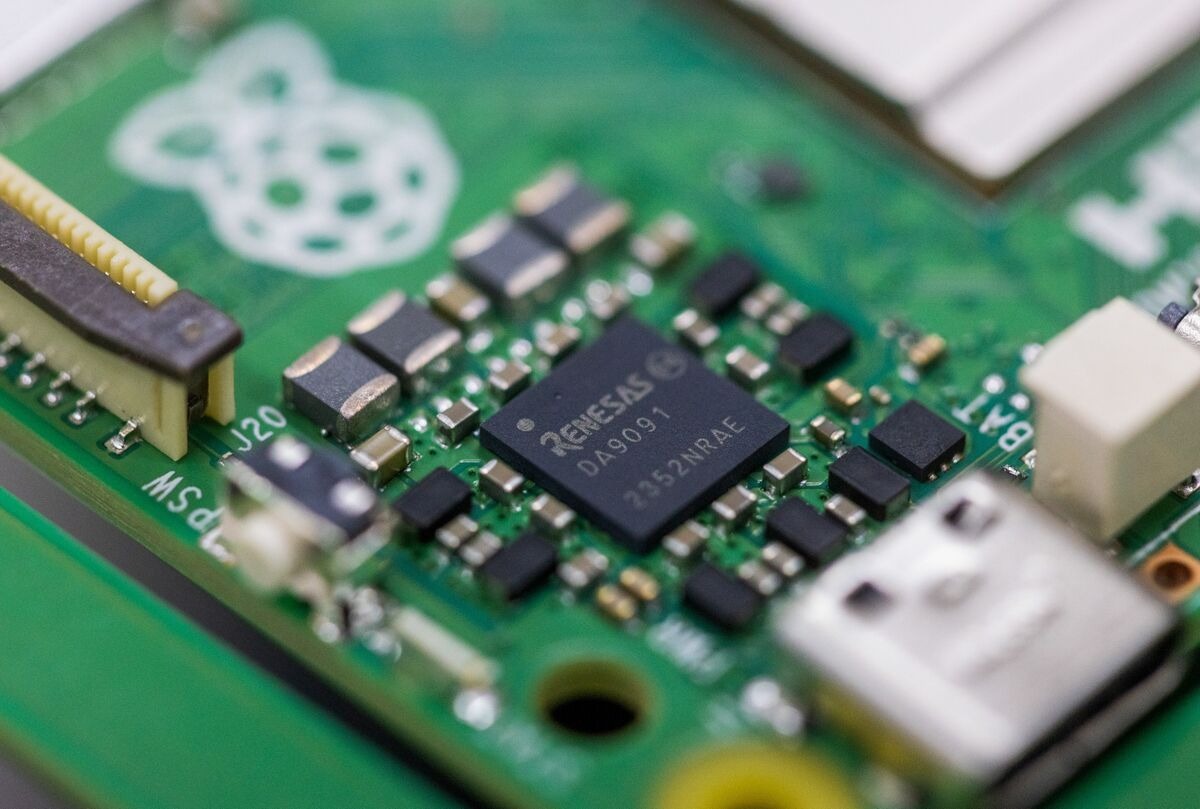

Japan's Renesas Electronics announced on Thursday its plans to acquire electronics design firm Altium for $5.9 billion in cash. This move positions Renesas to broaden its offerings by providing digital device design services to its customers, particularly in the automotive chip sector.

The acquisition reflects Renesas' strategic efforts to remain competitive and resilient in Japan's semiconductor industry, as the government pushes for improvements in competitiveness and supply chain resilience. Renesas, a key supplier of chips to automakers like Toyota and Nissan, aims to enhance its capabilities by integrating Altium's digital tools for engineers and designers who develop circuit boards.

Renesas CEO Hidetoshi Shibata emphasised the importance of diversifying the company's offerings beyond traditional device manufacturing to avoid marginalisation in the industry. The acquisition of Altium is seen as a strategic move to achieve this goal.

Under the terms of the deal, Renesas will pay A$68.50 per Altium share, representing a 34% premium over Altium's closing price on Wednesday. The transaction will be financed using cash reserves and bank loans. Altium, headquartered in the United States and listed in Australia, reported sales of $263 million in the year ended June 2023, with a robust earnings margin.

Altium CEO Aram Mirkazemi expressed confidence in the deal's ability to accelerate its execution and praised Renesas' commitment to supporting their strategy.

The acquisition has received approval from both companies' boards of directors but is subject to approval from Altium shareholders, Australian courts, and regulators. Renesas anticipates the deal to be finalised in the second half of the year.

Following the announcement, Renesas' shares initially fell but later recovered, while Altium's shares surged by 28%. Market analysts expressed cautious optimism about the deal, noting the absence of a negative reaction but suggesting that investors may still be evaluating its long-term implications.

The acquisition of Altium underscores Japan's ongoing efforts in outbound mergers and acquisitions, with the country witnessing growth in overseas deals. Renesas, which was formed in 2010 through a merger and achieved a turnaround with government support, has previously made strategic acquisitions to expand its business portfolio.

Also Read : Pakistan's scrap imports plummet 76% in January Oil settles at highest in nearly 8 weeks on strong economic growth