India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

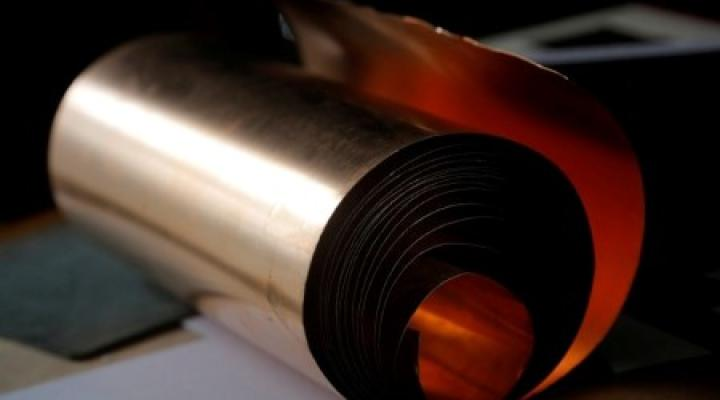

Nickel prices surged to their highest level in ten weeks as concerns about the escalation of US sanctions against Russia prompted traders to cover bets on lower prices for the metal used in stainless steel and electric vehicle batteries. The three-month nickel contract on the London Metal Exchange, was up 1.6% at $17,195 per metric tonne after surpassing the 100-day moving average of $17,052 and reaching its highest level since December 15 at $17,200.

US President Joe Biden has stated that Washington will release a hefty sanctions package against Moscow on Friday. Russia, a significant producer of refined nickel, palladium, and aluminium, marks the two-year anniversary of its invasion of Ukraine on February 24. Western leaders have also expressed outrage at the news from Russian authorities that Russian opposition leader Alexei Navalny died in prison last week.

Despite the market reaction, the actual impact on the supply and demand from any possible sanctions on Russian base metals would be limited because the US reduced Russian imports after imposing high tariffs on them a year ago. The nickel market is also oversupplied because of rising production in Indonesia.

Other LME metals registered modest moves as markets reopened in top metals consumer China after the Lunar New Year holiday. "Sentiment remains focused on the US Federal Reserve messaging and the timing of interest rate cuts, coupled with fears over the health of China's real estate sector and stimulus expectations," said Standard Chartered analyst Sudakshina Unnikrishnan.

The macroeconomic situation would improve for base metals in the second half of 2024, leading to higher prices across the complex apart from nickel, Unnikrishnan added. In other metals, LME aluminium lost 0.1% to $2,216.50, copper firmed by 0.1% to $8,550.50, zinc added 0.1% to $2,396, lead dipped 0.2% to $2,073 and tin was down 0.7% at $26,105.

Also Read : Aluminium futures fall on low demand EU carbon tax to have limited Impact on India's aluminium exports