India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

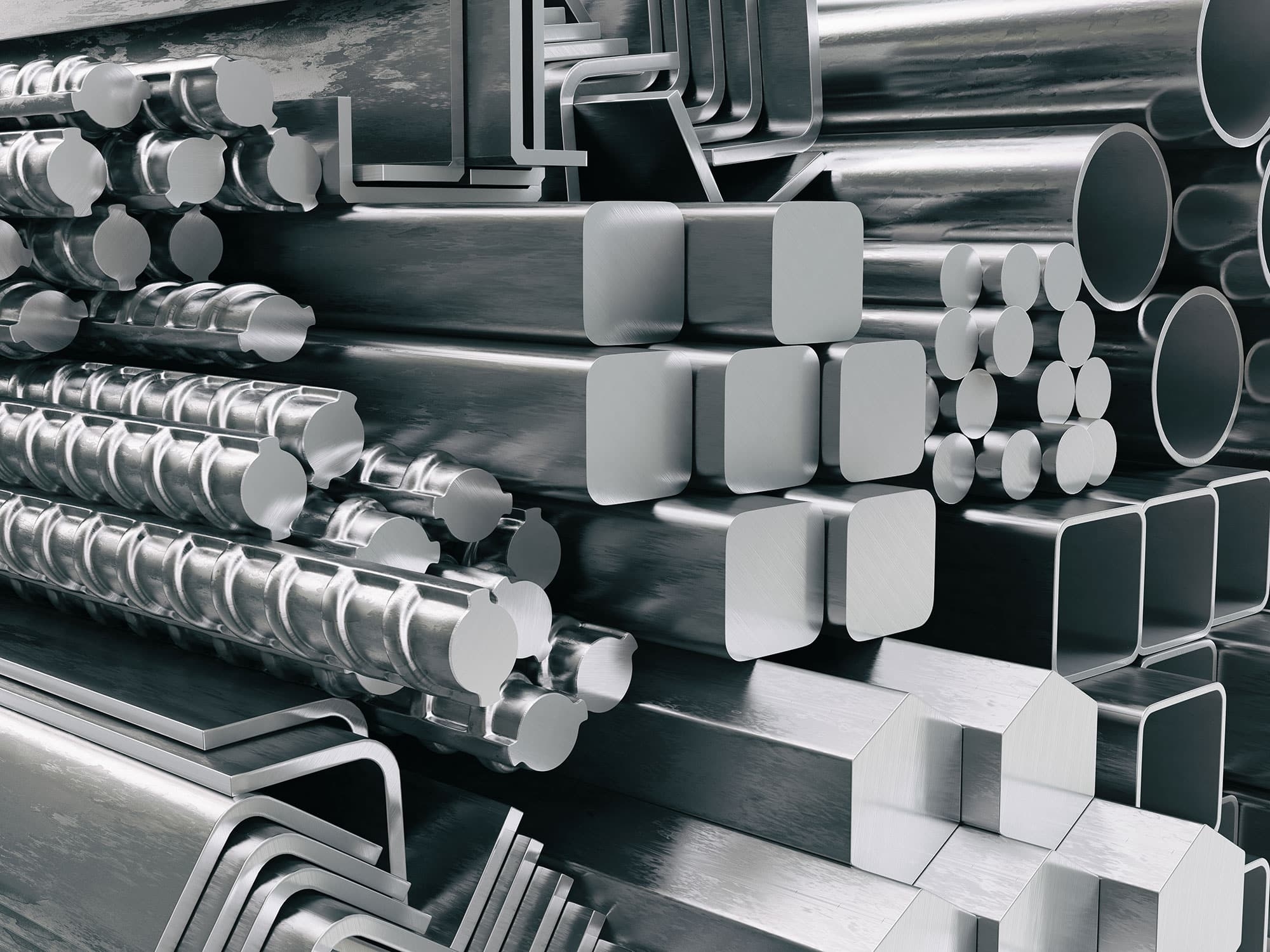

The global galvanised steel market is expected to increase dramatically in the following years, with revenue reaching $321.4 billion by 2032. From 2023 to 2032, this growth is predicted to increase at a compound annual growth rate (CAGR) of 7.2%. The Asia-Pacific area, estimated to be worth approximately $65 billion in 2022, is a major participant in this industry. The region's growth is expected to exceed an 8% CAGR during the forecast period, highlighting its importance in global market dynamics.

The Asia-Pacific region is one of the major participants in the market for galvanised steel. In 2022, its market value was estimated to be $65 billion, demonstrating its industry leadership.

The region's growth trajectory is projected to exceed an 8% CAGR from 2023 to 2032, indicating robust expansion and increasing demand. Factors contributing to this growth include rapid industrialization, urbanization, and infrastructural developments in countries such as China, India, and Japan.

China, in particular, is a major consumer and producer of galvanized steel. The country's booming construction industry, along with its extensive manufacturing sector, fuels the demand for galvanized steel products. Moreover, government initiatives aimed at modernizing infrastructure and promoting sustainable building practices further boost market growth in the region.

India is another significant market within Asia-Pacific. The country's growing construction activities, coupled with an expanding automotive industry, drive the demand for galvanized steel. Additionally, India's focus on developing smart cities and upgrading existing infrastructure presents lucrative opportunities for market players.

The galvanized steel market is poised for substantial growth, driven by increasing demand from key end-user industries and regions. Market players can seize opportunities and achieve sustained success in this dynamic industry by focusing on innovation, sustainability, and strategic expansion.

Also Read : Global steel output down 1.6% y/y in January; India reports 7.3% jump Stainless steel production surged by 4.6% y/y globally in 2023