India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

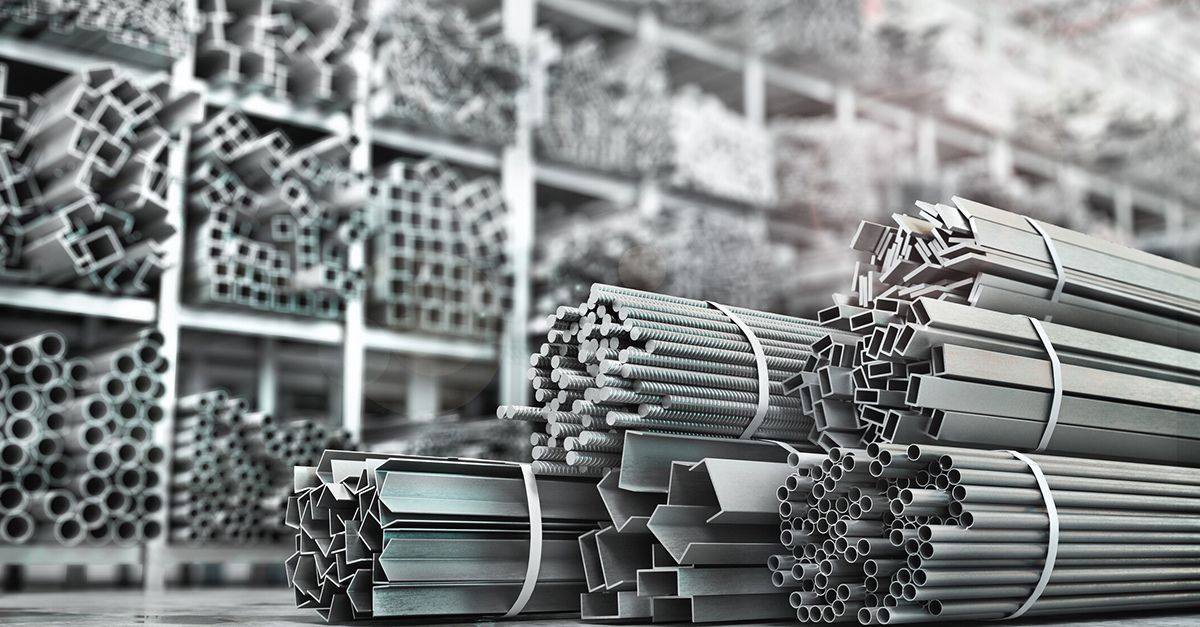

As speculation grows over a possible second Trump administration, India's steel industry is closely evaluating the risks posed by potential tariff hikes on exports to the U.S. Industry leaders fear that increased duties on steel and aluminum could significantly disrupt trade, affecting profitability and global competitiveness.

The U.S. has historically been a crucial market for Indian steelmakers, and any protectionist policies could force companies to seek alternative markets. Major players, including JSW Steel and Tata Steel, are already assessing strategies to mitigate risks. One possible response is expanding exports to the Middle East, Europe, and Southeast Asia while strengthening domestic demand.

Additionally, industry experts emphasize the need for policy intervention from the Indian government to cushion the impact of potential trade restrictions. Measures such as export incentives, domestic infrastructure projects, and trade negotiations with the U.S. could help stabilize the sector.

SteelBazaar’s market analysts suggest that while short-term challenges may arise, India's steel industry is well-positioned to adapt through innovation, sustainability initiatives, and strategic diversification. The sector's ability to pivot quickly will determine how well it weathers the storm of global trade shifts.

With the Indian government actively monitoring developments, stakeholders in the steel industry remain cautiously optimistic while preparing for all possible scenarios.

Also Read : Tata Motors Opens 8th Vehicle Scrapping Facility in Kolkata Tata Steel Begins £1.25 Billion Green Transformation at Port Talbot Plant