India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

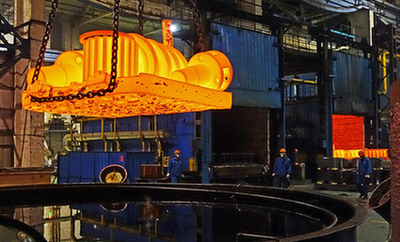

Poor steel production margins have encouraged steelmakers to cut operating rates through blast furnace maintenance ahead of the Chinese Lunar New Year, but most steel mills are expected to see high rates over the holiday, resulting in strong iron ore demand.

According to some industry insiders, North Chinese steel mills have kept a 7–14 day iron ore supply on hand, although they might keep restocking portside before the holidays.

"We have a blast furnace that is undergoing maintenance and is expected to be completed before the holiday," a source from a steel factory in Shandong stated. The source went on to say that they will continue to run at high rates over the holidays.

A Jiangsu-based steel mill source said that production margins increased slightly from a week ago due to the decline in iron ore prices and domestic coke prices. “We would keep high operating rates during the break,” the source said, adding that they held more than 20 days of raw material stock. Some steel mills chose to increase the frequency of iron ore restocking but reduce the amount of the restocking volume in each round.

“Small quantity but increased frequency of purchases,” an Anhui-based steel mill source said, adding that it would have less impact on the market price. The source said they have finished the first two rounds of restocking. Sources said that most of the steel mills would continue their iron ore restocking activities from China portside until the last week before the holidays to support the high operating rates during the Lunar New Year holidays. Construction sites in multiple regions in China would stop working during the break.

Some market participants were concerned that the high crude steel output and lackluster downstream steel demand during the break could pressure the finished steel prices and dampen the production margins. This would likely affect the operating rates of steel mills after the holiday, which may lead to lower iron ore demand. However, a steel mill source in Jiangsu said they believed that steel demand would likely get support from the country’s policies.

Also Read : Local Chinese rebar prices rose 1.2% in late May Indian steelmakers demand measures to address growing steel imports