India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

The global steel industry is witnessing a transitional phase marked by slowing demand in China, heightened protectionism, and cautious optimism for recovery. While current consumption is moderating, long-term growth is expected to rebound strongly by the late 2020s and early 2030s, led by developing economies.

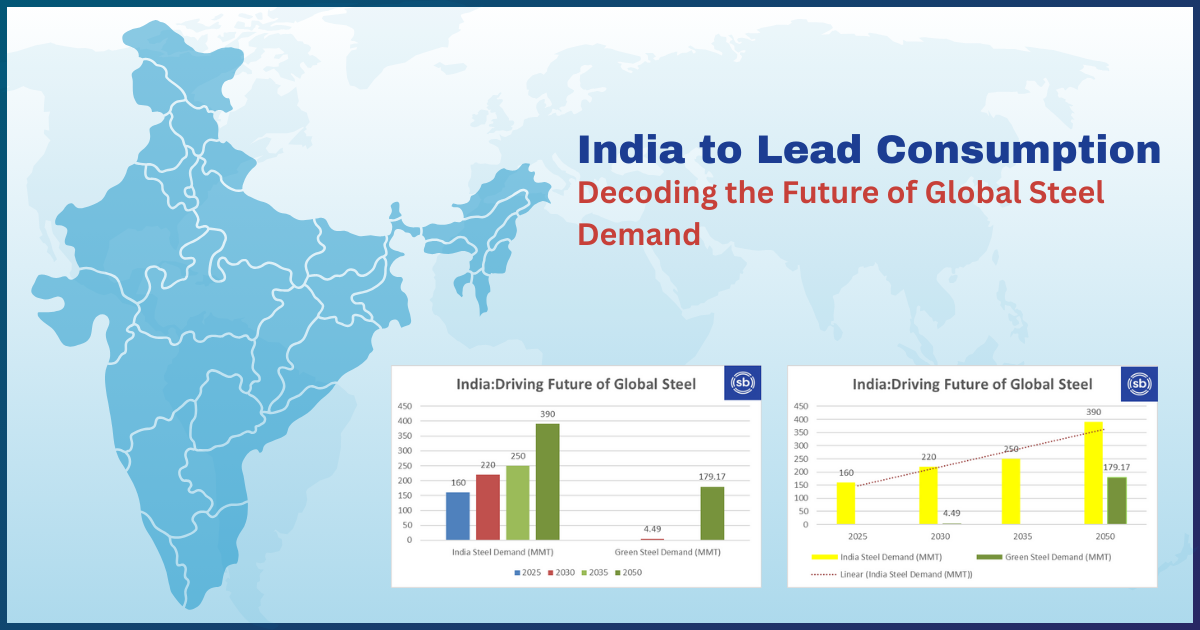

India is emerging as the centerpiece of future global steel demand. Unlike many economies where output has stagnated, India’s production surged 33% between 2019–2024. With projected demand growth of 8–9% in 2025, the nation is set to drive consumption across construction, infrastructure, and manufacturing. By 2035, Indian demand is forecast to reach 240–260 MMT, making it the largest growth market globally.

The rise of green steel is poised to transform the industry. In India, demand is projected to surge from 4.49 MMT by FY30 to an extraordinary 179 MMT by FY50, driven by the construction and infrastructure sectors. This shift underscores the urgency for investment in low-carbon technologies such as hydrogen-based DRI and EAFs.

Scale & Modernize: Indian steelmakers must expand capacity while integrating advanced technologies.

Policy Push: Governments should incentivize green production and strengthen domestic demand through infrastructure projects.

Also Read : BALCO Produces First Metal from India’s Largest Aluminium Smelter India’s Crude Steel Output Crosses 100 MT (Jan–Aug 2025)