India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

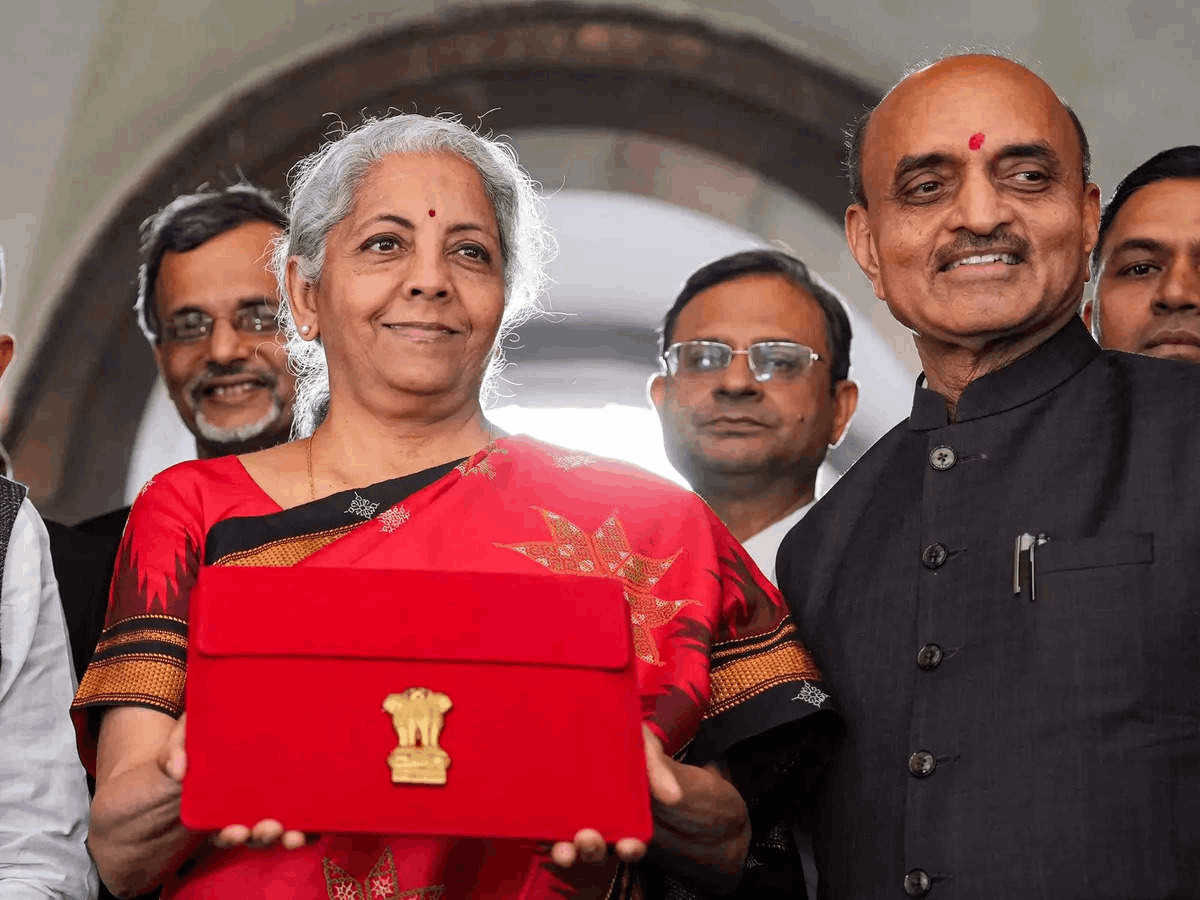

As India approaches Budget 2024, its economic landscape is dominated by a coming general election and global concerns about debt and sustainability in the face of declining growth. However, it is critical to move away from the developed world's myopic focus on debt reduction and embrace India's unique growth story, which still has a long way to go. Similarly, the government's ambition to do what is right for an economy at a vital juncture should not be limited by an interim budget provided ahead of the general elections.

Fiscal targets and fiscal consolidation road map

The fiscal deficit is projected to be 5.9% in 2023-24, a 50-basis-point decrease from 2022-23. Sticking to these goals will reassure sovereign rating agencies and investors. Additionally, it will contain the rising global borrowing costs and yields.

Furthermore, a medium-term fiscal consolidation roadmap with a clear explanation of the fiscal journey ahead is critical. The finance minister reaffirmed his commitment to reducing the fiscal deficit to 4.5% by 2025-26.

Maintain the investment tempo

Reiterating the need for a capex (capital expenditure) boost and doubling down on such spending will signal positive externalities, cut logistical costs in the economy, make India globally competitive, and improve exports. It is admirable that the government increased capital expenditure from 1.7% in 2019–20 to 3.3% in 2023–24, the highest level since 2007–08. The economy and employment market have benefited from this through the capital goods and infrastructure ecosystem.

Therefore, raising capital expenditure by a minimum of 25% to ₹12.5 trillion in 2024–2025 may confirm these indications and assist in bringing in private capital that has been trailing. Given India's uncertain neighbourhood and geopolitical environment, sustaining the current pace of defence capital investment will be critical.

After a "lost decade" that ended in 2020, Indian manufacturing is currently amid a multi-year comeback. Facilitating the expansion of MSMEs (micro, small, and medium companies) and minimising the regulatory and compliance load on taxpayers and other economic stakeholders must continue to be top priorities, as must efforts to make business easier.

Supporting economic growth

The government must focus on nurturing and developing India's people and physical capital and investing in sectors that will boost the country's potential growth and propel it towards India's Amrit Kaal objectives. It is worth noting that the global economy is expected to slow even further in 2024, reaching 2.6%. Furthermore, conditions are expected to deteriorate in the coming year due to rising interest rates, geopolitical tensions, and a decline in the world's leading economies.

Lastly, the budget should be non-negative and without system shocks, as the inclusion in global bond indices has focused squarely on government finances and fiscal responsibility. Thus, the financial calculations and presumptions need to be reliable. Given the current global macroeconomic background, volatility in foreign funds for domestic requirements carries major risks and costs, as demonstrated by the global financial crisis and taper tantrum occurrences.

Also Read : Govt Plans Joint Approach for International Steel Partnerships Navigating economic crossroads: insights into India's interim budget