India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

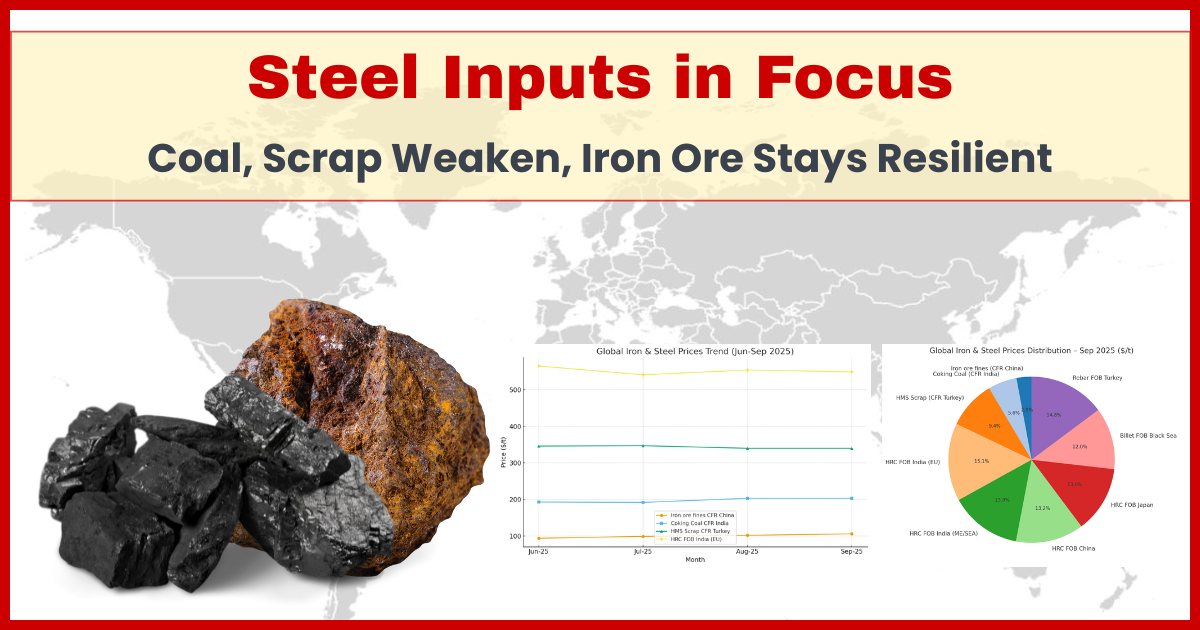

In September 2025, global steelmaking raw materials largely softened amid weak demand and cautious buying. However, iron ore prices bucked the trend, supported by Chinese restocking activity.

Iron ore gained momentum on active Chinese portside purchases and restocking needs from mills. Despite subdued global steel output, firm Chinese demand provided a price cushion.

Coking Coal: Prices held steady with limited supply-side disruptions and balanced demand from Asian mills.

Imported Scrap: South Asian markets stayed muted due to festive slowdown in India and cautious procurement in Pakistan and Bangladesh.

Flat steel export offers from India slipped further, reflecting weak overseas demand and competitive regional pricing.

Near-term: Raw material prices expected to stay rangebound, with iron ore maintaining relative firmness.

Watchpoints: Chinese buying patterns, coal supply flows, and South Asian scrap demand recovery post-festive season.

Also Read : Tariff Relief for UK Cars and Aircraft in New US Trade Agreement Tesla’s Roadmap for Future: 'Redwood' EV and Indian Manufacturing