India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

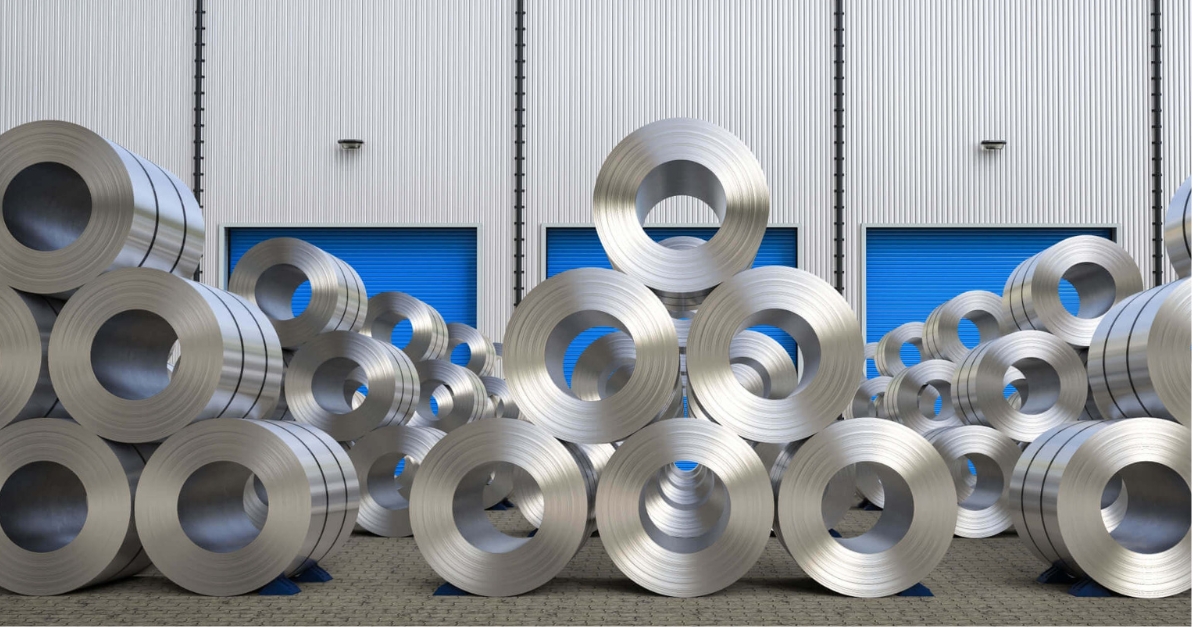

Former U.S. President Donald Trump's decision to reinstate tariffs on steel imports is raising concerns about a potential metal glut in Asia. By imposing higher tariffs on foreign steel to protect American manufacturers, the move is expected to redirect surplus steel to Asian markets, worsening an already oversupplied situation.

Asian steel producers, particularly in China, Japan, and South Korea, are likely to be the most affected as they seek alternative markets for their products. Analysts warn that this could lead to increased competition and price drops in the region. “The redirected steel will flood Asian markets, intensifying price wars and squeezing profit margins,” said Hiroshi Tanaka, an analyst at Tokyo Steel Research Institute.

China, the world’s largest steel producer, is especially vulnerable to the tariff impact, as its exports to the U.S. are now expected to flow into neighboring Asian markets. This could lead to a surplus, further exacerbating the region’s oversupply issues.

Experts believe that the situation may trigger trade tensions as Asian countries grapple with the influx of cheaper steel. Some nations might impose protective measures to safeguard their domestic industries, potentially leading to trade disputes.

Industry leaders are calling for strategic responses, including boosting domestic demand and exploring new export markets to mitigate the impact. As Asia braces for the ripple effects of Trump’s steel tariffs, the global steel landscape faces heightened uncertainty.

Also Read : KABIL & CSIR-IMMT ink MoU for critical minerals cooperation Thermal coal prices expected to decrease in 2024 due to surplus supply