India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

China's imported iron ore prices are expected to soften in April 2025, influenced by a confluence of macroeconomic shifts and market dynamics. According to industry insights, increased supply from global exporters and sluggish domestic demand in China are exerting downward pressure on prices. For India, this trend could be a strategic advantage.

🌏 Global Dynamics Behind the Trend

The global iron ore landscape is shifting in April 2025 due to:

Rising Export Volumes: Major suppliers like Australia and Brazil have ramped up exports, contributing to increased global inventory.

Muted Demand in China: Steel production in China is cooling off due to tightened environmental policies and reduced construction activity.

Economic Deceleration: Slower GDP growth and declining industrial output in China are softening the demand for raw materials, including iron ore.

🇮🇳 Positive Outlook for the Indian Steel Sector

India stands to benefit significantly from this market softening:

Lower Input Costs: With falling iron ore prices, Indian steelmakers may see a reduction in production costs, improving their profit margins.

Competitive Edge: Lower costs could allow Indian companies to offer more competitive pricing in global markets.

Stock Market Gains: Investors are optimistic, with expectations of upward movement in stock prices of major players like Tata Steel, JSW Steel, and SAIL.

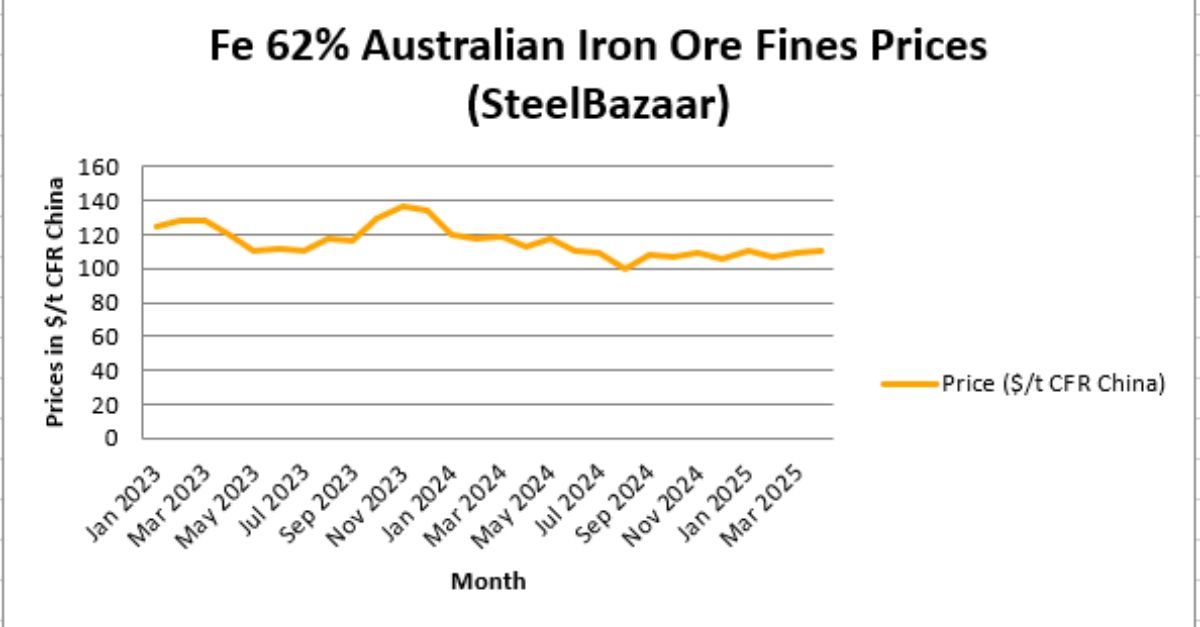

📊 Market Visualization: Iron Ore vs Indian Steel Stocks

Note: Chart is for illustrative purposes only and does not represent actual data.

The chart above illustrates the expected inverse trend between China’s iron ore prices and the performance of Indian steel stocks through April 2025.

🧭 Strategic Implications

As China enters a phase of moderated raw material consumption, Indian manufacturers could capitalize on cost advantages and expanded export opportunities. This trend may also enable better price stability for downstream buyers and infrastructure projects in India.

📣 SteelBazaar Take

This price dip in iron ore isn’t just a global supply story—it’s an opportunity for Indian steel to assert itself competitively on the international stage.

Keep following SteelBazaar News for up-to-date insights that shape the future of steel.

Also Read : Fitch Ratings revises Tata Steel's outlook to negative Indian govt delegation visits Singapore to boost trade and collaboration