India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

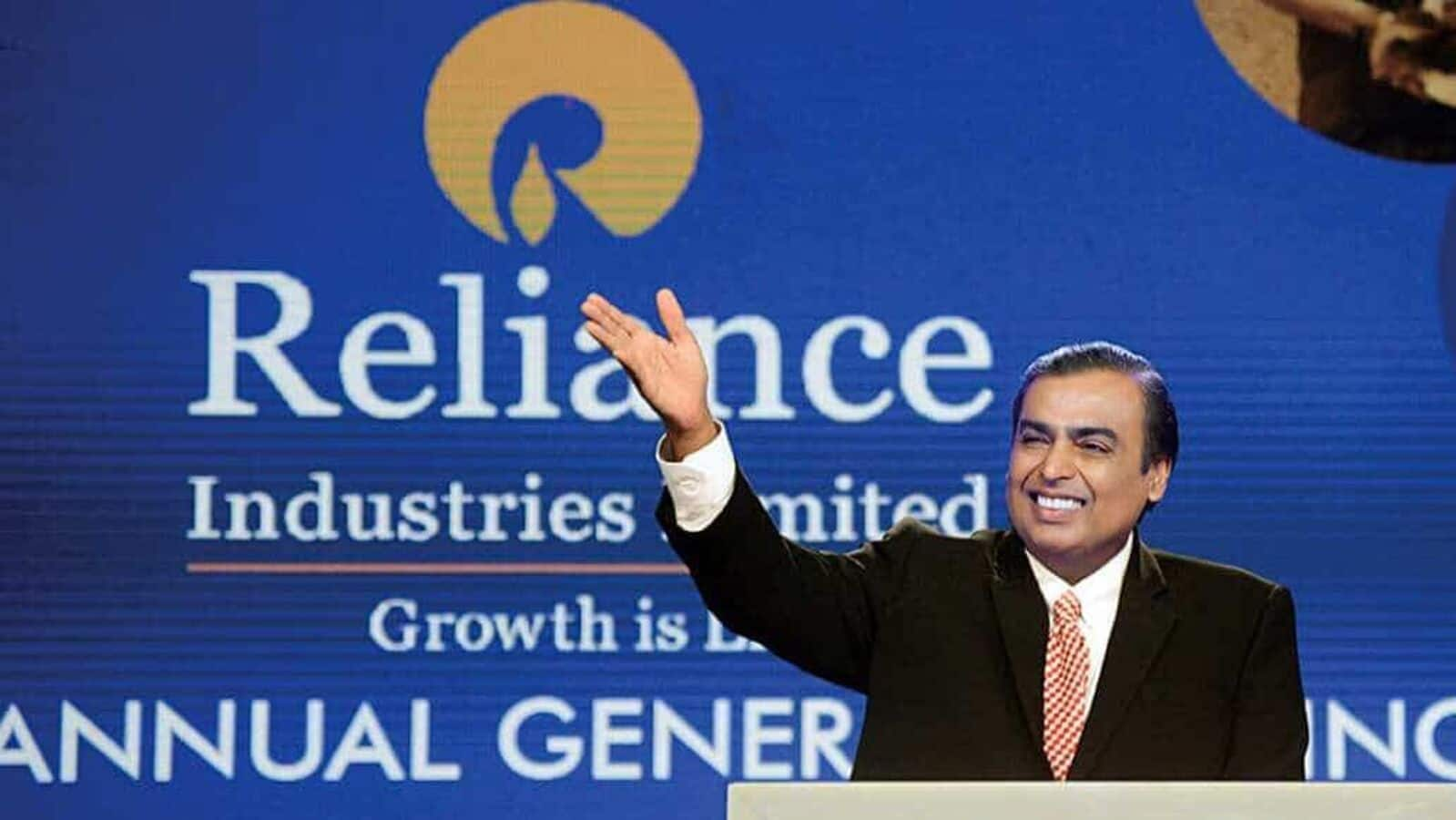

After shares of the main firm RIL reached a record high in trading today, the oil-to-telecom conglomerate Reliance Industries Ltd's market capitalisation crossed the ₹20 lakh crore threshold on Tuesday.

With this, the Mukesh Ambani-owned conglomerate also became the first Indian company to hit a market capitalisation of ₹20 lakh crore.

Following Reliance Industries comes the Tata Group giant Tata Consultancy Services (TCS) with a market capitalisation of ₹15.07 lakh crore, while HDFC Bank comes third with ₹10.56 lakh crore.

Reliance Industries first crossed the mark of ₹10 lakh crore in market capitalisation for the first time on November 28, 2019.

The most recent listing, Jio Financial Services, is currently trading at a market capitalisation of ₹1.70 lakh crore. One must remember that Reliance's share price trades at the ex-demerger price.

The oil-to-retail conglomerate reported a net profit of ₹17,265 crore for the December quarter.

Brokerage firm Bernstein has raised its price target on Reliance Industries to ₹3,160 from ₹3,000 earlier. It expects Reliance's Earnings per Share (EPS) to grow at a compounded annual growth rate of 20% through the financial year 2026, with retail and telecom being the key drivers.

While it expects the oil-to-chemicals earnings growth to be flat, retail will show strong growth momentum.

Bernstein has cited several catalysts for investors of Reliance Industries, including additional spin-offs of businesses post the General Election, an increase in telecom tariff rates, new announcements in the new energy business and improvement in the company's free cash flow.

Out of the 35 analysts that track Reliance Industries, 28 or 80% of them have a "buy" recommendation, five say "hold", while the other two have a "sell" recommendation.

The 14-day relative strength index (RSI) on the charts stood at 64.9, indicating the stock is neither oversold nor overbought. The counter has a one-year beta of 0.5, suggesting very low volatility.

Shares of RIL gained nearly 14% this year and have rallied nearly 40% in the last one-year period.

The stock has delivered positive returns on an annual basis since 2015. The only year in which it delivered negative returns since 2012 was 2014, during which it fell a paltry 0.5%.

Also Read : JSW, POSCO Join Hands to Explore 6 MTPA Steel Plant in India WABAG and PEAK to build 100 bio-CNG plants from sewage methane