India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

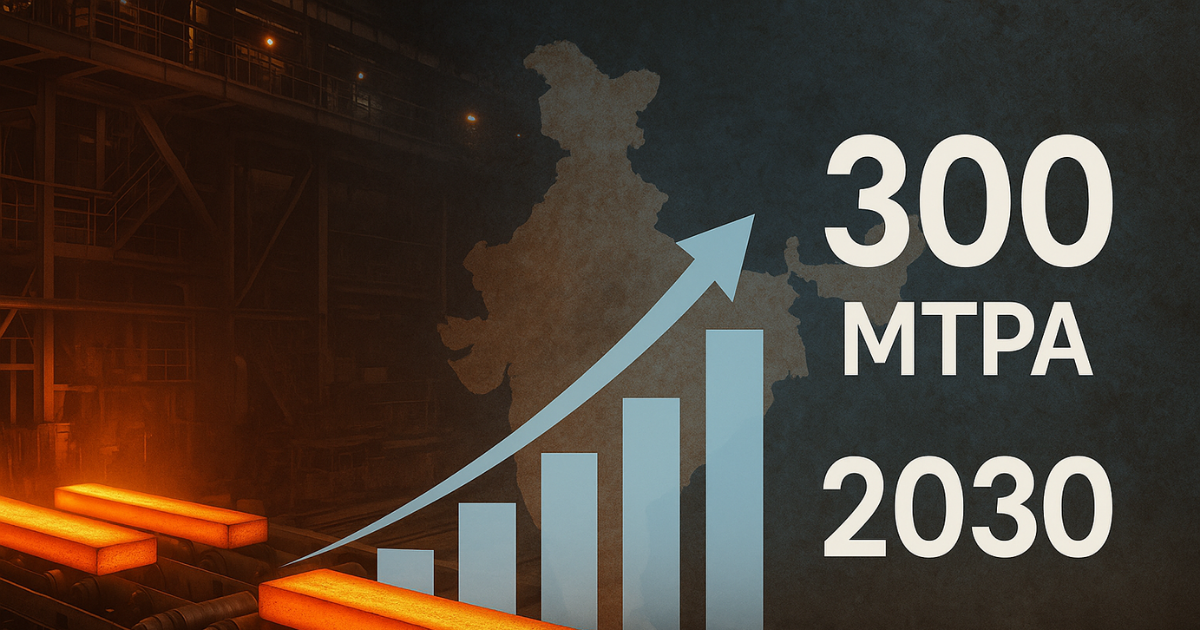

India is working to expand its steel production capacity from 205 million tonnes per annum (MTPA) to 300 MTPA by 2030–31. However, the journey is riddled with critical challenges spanning supply chain limitations, trade dynamics, and regulatory hurdles.

A key concern is India's 85% dependence on imported coking coal, which impacts production costs and energy security. Limited domestic availability of steel scrap and rising global competition—particularly from Chinese imports—add to pricing pressures. Additionally, environmental issues, such as high carbon emissions from traditional blast furnaces, call for greener alternatives.

Policy delays, inefficient logistics, and high financing costs further slow infrastructure development and new plant setups.

To overcome these challenges, industry experts recommend a five-pronged strategy:

Focus on green and specialty steel production.

Improve logistics and raw material access.

Invest in clean technologies to cut emissions.

Implement policy reforms to simplify project approvals and funding.

Encourage public-private partnerships for faster execution.

If effectively executed, this roadmap could position India as a global leader in sustainable steel manufacturing and support its broader $5 trillion economy goal.

Also Read : US trying to help India get lower prices for Russian oil : Biden envoy India to become 3rd largest market for utility-scale batteries by 2030: IEA