India–US Trade Tensions Rise Over Steel and Auto Tariffs NMDC Limited reports a 38% drop in Q4 FY24 consolidated net profit RINL to Raise $23 Million Through Land Sales Amid Crisis

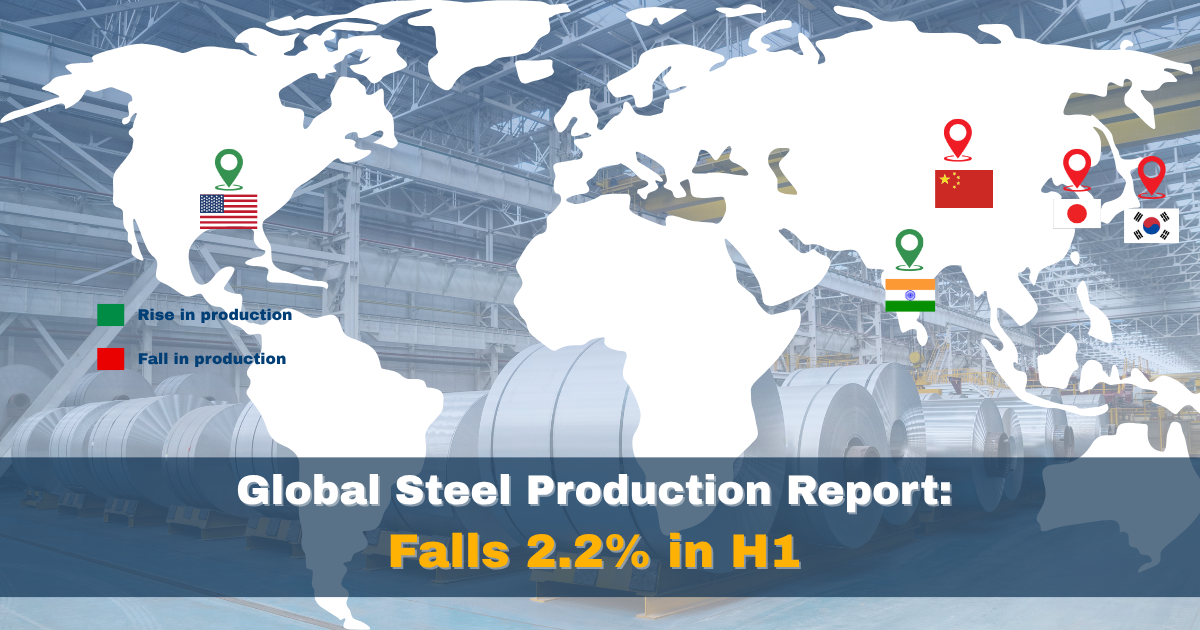

Global crude steel production declined by 2.2% in the first half of 2025, totaling 934.3 million tonnes, according to the World Steel Association. The downturn reflects sluggish industrial demand, with China—the world’s largest steel producer—leading the drop.

In June alone, global steel output fell 5.8% year-on-year to 151.4 million tonnes. Asia bore the brunt of the decline, particularly China, where production plunged 9.2% in June, marking the lowest monthly level this year. For the first six months, China's output dropped roughly 3% to 514.8 million tonnes.

Meanwhile, other major Asian producers also saw declines: Japan’s output dipped 4.4% and South Korea fell 1.8%. India stood out as the exception, posting a strong 13.3% increase in June, reaching 13.6 million tonnes.

In contrast, the U.S. and North America recorded modest growth. U.S. steel output rose 4.6% in June, with North America overall up 1.2% year-on-year.

The downturn is largely attributed to reduced demand in China’s construction and real estate sectors, coupled with broader global economic uncertainty. Industry analysts expect muted recovery in the near term, with little sign of demand rebounding significantly in the second half of the year.

As the global steel industry navigates this slowdown, regional resilience—especially in India and North America—may provide some stability amid broader market challenges.

Also Read : Stainless Steel Production Rises 5% Globally in Q2 Oil drops on weak China data; set for first monthly rise since Sept